Welcome to Money As If, that $75 voucher you won on your first pull at the penny slots. Today's bets:

Leavin' Las Vegas

What to do if you're priced out of health insurance

The hidden costs of weight loss medications

— Jeanine

P.S. Liking Money As If? Share that referral link below!

IN THESE, OUR (POSSIBLE) END TIMES

Is Polymarket a viable retirement strategy?

So the original subject line of today's newsletter was "Is Kalshi a viable retirement strategy," but on Wednesday, Polymarket — a competing "prediction market" that essentially allows people to bet on anything — announced a big deal with Dow Jones, so I adjusted the news peg.

I wish I didn't have to talk about either (Kalshi or Polymarket). No judgment to anyone who uses these platforms, but "should I build a nest egg by betting all my savings on whether Jensen Huang says million, billion, or trillion 20-plus times during NVIDIA Live at CES 2026?" should have a pretty obvious answer, no?

Time to break out this old reliable.

What is the casino economy — & why?

But Polymarket and Kalshi are huge. The latter reported its trading volumes surpassing $1 billion each week in December.

And they're just a small part of the proverbial "casino economy," where people are taking big, risky bets with their money — buying crypto, meme coins, NFTs, and other speculative investments, using sports betting apps, chasing algorithms — on the very small chance that they'll strike it rich, while understanding that they're most likely to lose.

The casino economy is currently chicken-and-egging it with financial nihilism, the increasingly popular belief, particularly among young people, that the traditional paths to wealth and financial stability will never, ever yield results, no matter how hard you work or how closely you follow the rules, and so aren't even worth your time or consideration.

And listen, I get it. I certainly do. The job market is a mess, particularly for entry-level applicants. The path to affluence increasingly requires generational wealth. Everything costs at least $100.

A soft pitch against financial nihilism

But, despite what ChatGPT might think, I just can’t bring myself to embrace or endorse financial nihilism (or even nihilism in general, seeing as this sort of hopelessness isn't just affecting how we view money).

For one, there is usually something you can do to improve or at least stabilize financial outcomes.

They might be small (like applying for unemployment ASAP in the event of a job loss), unideal (like opting not to buy a house, even though it's traditionally recommended) or even unfair (like postponing retirement), but they are, you know, things.

Beyond that, there's a big gulf between doing nothing and doing something that is almost guaranteed to make matters worse for you.

And, sure, a lucky few have made money (or appear to have made money) — and headlines — with a "get rich or die trying" approach. But these few are exception, not the norm, and, quite frankly, just another trick the house is using to ensure it always wins.

Fuel your business brain. No caffeine needed.

Consider this your wake-up call.

Morning Brew}} is the free daily newsletter that powers you up with business news you’ll actually enjoy reading. It’s already trusted by over 4 million people who like their news with a bit more personality, pizazz — and a few games thrown in. Some even come for the crosswords and quizzes, but leave knowing more about the business world than they expected.

Quick, witty, and delivered first thing in the morning, Morning Brew takes less time to read than brewing your coffee — and gives your business brain the boost it needs to stay sharp and in the know.

DEADLINES

Emergency care

I wasn't planning on revisiting the health insurance affordability crisis so early in the new year, mostly because it feels too much like simply screaming into a void. But Jan. 15 is the last day of 2026 Affordable Care Act (ACA) open enrollment, and just in case you or someone you know hasn't purchased coverage due to prevailing sticker shock, I figured I'd share a few alternatives I covered for Investopedia.

None of them is … great. (Plans sold on the ACA exchanges come with key protections, like coverage for pre-existing conditions and annual maximum out-of-pocket caps, that off-marketplace products don't have to provide.) But they could prove better than nothing if you shop very, very, very carefully, and understand what you signed up for before using it.

A few things to note as you finalize plans:

Subsidies still exist. They're just, as of this moment, available to fewer people (more on this in a sec). You'll need to buy health insurance through the ACA marketplaces to get this assistance, however, so, if you’re eligible, that's the best place to get last-minute coverage.

There’s some late-breaking movement in Congress that could belatedly extend the Biden-era enhanced premium tax credits. Keep an eye on the Senate this week if the expiration of these credits is why you're priced out of ACA coverage. (It's working on a diluted version of a bill that passed the House yesterday.)

Open enrollment ends on Jan. 15. ACA plans purchased between now and then start on Feb 1. If you miss that deadline, you'll need to qualify for a special enrollment period to buy insurance through the marketplaces. You can, however, purchase alternative (though, again, not great) coverage at any time.

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

Service-y: What to do if you "Bought Now, Must Pay Later-ed" too much over the holiday shopping season.

I want to snark on this important coverage from the Wall Street Journal — Parents are going broke from their kids' sushi obsession — but we ordered from our local joint over Christmas break, and a couple of rolls and accoutrements, plus delivery fees, cost $75.

I'm not really saying "I told you so" about $895-a-year premium credit cards, but I told you so about $895-a-year premium credit cards.

IT’S A TRAP

Gas-lite

Just to be clear, I’m in no way philosophically opposed to GLP-1s. I think of weight loss in the same way that I think of financial health: Neither should, by default, have to be so damn hard. Health-wise, of course, taking weight loss medication is between you and your doctor.

Financially, I did think, "How rich?" when third-tier (sorry, not sorry) Real Housewife Emily Simpson tried to sell me some "super-affordable" $200-a-month GLP-1 medication via my Instagram feed.

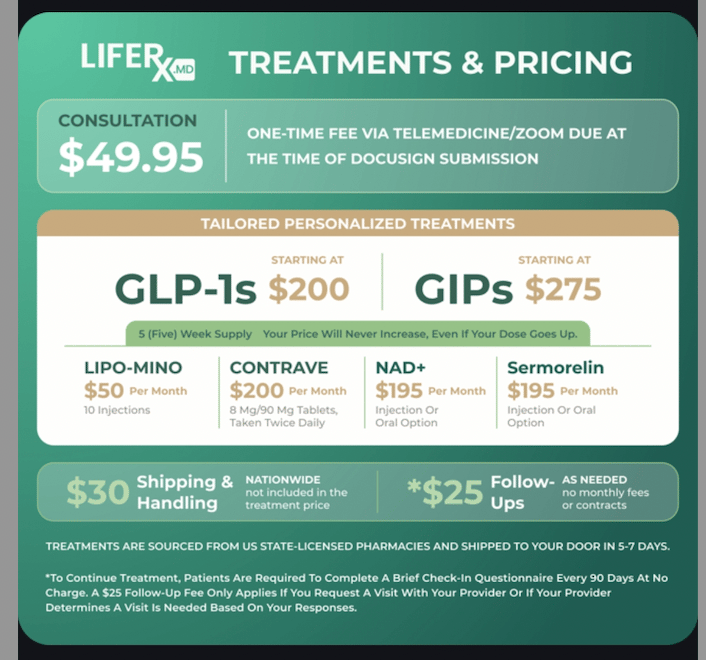

An image LifeRX.md sent via text after I went to book a consultation

Setting aside that $200 is not "super-affordable" for anyone living on the low end of the K, I've noticed some … gaslighting going on as GLP-1 providers try to make the most of "New Year, New You" season. So, just so you know, ahead of adding these to your budget:

The advertised price rarely captures all costs. LifeRX (Housewife Emily's partner) leans pretty heavily into the "only $200 a month; no subscription fees" angle, but, as the graphic above shows, you'll have to pay $49.95 for an initial consultation, $30 a month for shipping and handling, and $25 for any follow-ups your provider deems necessary during recurring 90-day check-ins.

"Starting at" prices might not apply to big brands, like Ozempic, Wegovy, or Zepbound. Despite attempts to stop the practice, some online telehealth services continue to sell knockoff GLP-1 compounds— and while these places can usually get you the "real" stuff, it’ll generally cost extra.

Double-digit brand prices only apply if insurance covers the meds, and if you don't have Type 2 Diabetes or an obesity-related medical problem, like high cholesterol or blood pressure, it most likely won't.

Increasing your dose can increase costs. The starter dose of the new, heavily marketed Wegovy pill, for instance, costs $149 a month, while the second and highest tier doses cost $199 and $299 per month, respectively.

You'll also see tons of incentives, like limited-time lower drug prices, a first-month waiver of subscription fees, or special discount codes, at sign-up. But remember, these companies are banking on you loving your results and staying with them, so be sure to factor in long-term costs when making any final GLP-1-related financial decisions.

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.