Welcome to Money As If, the Ninja SLUSHi that a friend of your friend's friend's sister won at Target on Black Friday.

Today’s smoothies:

When the economy goes K-shaped

Discount theory

Welp, this green is certainly … fresh

— Jeanine

P.S. Liking Money As If? Share that referral link below!

IN THESE, OUR (POSSIBLE) END TIMES

How does a K-shaped economy end?

My go-to word for describing the U.S. economy over the last year or so has been "weird," which, I'll admit, seems (and sometimes feels) like code for "BAD," but, I swear, it isn't.

These days, 86% of Americans are stressed about grocery costs, and yet there's simultaneously a market for designer under-eye patches, $500 NY Jets (!) tickets, infinite Labubus, and $750 advent calendars.

There are several explanations for this, but the most universally accepted and, therefore, least controversial take is that we're in a K-shaped economy, meaning, essentially:

Some of us have, many of us … have not

And the haves—let's call them the top 10% of earners who currently account for nearly 50% of all U.S. consumer spending—are still working, still buying (a lot … like a lot, a lot), investing, and otherwise living well, which is great for them, sure, but not so hot for the rest of us at a micro- or macro-level.

Whoa, boy.

Recessions, generally speaking, have to actually happen in order to end. That's based on the principles of logic (or maybe Newton’s Third Law of Motion?), but it's also because recoveries generally follow major policy shifts and institutional changes that governments and businesses simply won’t make if, on paper, everything looks OK.

And right now, it does (we think), because while the lower half of the K is struggling, the top half has yet to break.

When will that happen?

Jury’s out. Economic forecasts for 2026 are opaque, albeit more optimistic than anyone in the bottom K—already experiencing financial strain—may expect. Global consulting firm RSM puts the odds of a recession in the next 12 months at 30%, down from 40% in July, and Morgan Stanley is hedging that we'll either have "stronger than expected demand" or a "mild" recession next year.

But history says—and, listen, I'm not saying this is good news—for the top part of the K to drop, we'll need a significant shock to our economic system.

The extremely K-shaped Gilded Age, for instance, ended after the Philadelphia and Reading Railroad and the National Cordage Company failed, triggered the Panic of 1893 and gave rise to Teddy Roosevelt, antitrust laws, labor protections, and increased unionization. And the Roaring 20s came to a halt after the Stock Market Crash of 1929, a slew of bank failures, and the Smoot-Hawley Tariff Act of 1930, among other things, ushered in the Great Depression—and, ultimately, the New Deal, which introduced important things like Social Security, unemployment benefits, and FDIC insurance.

FWIW—and, again, I’m not necessarily calling this good news—I’m way less bullish on the economy than RSM or Morgan Stanley, given we're pretty clearly in an AI bubble, where inflated company valuations directly mirror the ones that caused the Dotcom crash and ended the (also K-shaped) '90s tech boom.

So how can you prepare for now and then?

Nothing you probably don't already know, I'm afraid. For instance:

Prioritize emergency savings. (At least three to six, but up to two years' worth if you can manage.)

Avoid high-interest debt (and Buy Now, Pay Later loans) at all costs.

Learn your state's unemployment laws and apply ASAP in the event of a layoff.

Negotiate your bills, and if serious hardship strikes, see if you can defer certain payments, like your mortgage or student loan.

And I hate to say this, because it's both stupid and annoying, but I have to say it: Look for ways to diversify your income. So, yes, consider a side hustle or at least brainstorm back-up revenue streams (if you've got savings, stick them in a high-yield to generate at least some passive income, for instance), because, no matter what happens today or tomorrow, job security still isn't what it used to be.

The Year-End Moves No One’s Watching

Markets don’t wait — and year-end waits even less.

In the final stretch, money rotates, funds window-dress, tax-loss selling meets bottom-fishing, and “Santa Rally” chatter turns into real tape. Most people notice after the move.

Elite Trade Club is your morning shortcut: a curated selection of the setups that still matter this year — the headlines that move stocks, catalysts on deck, and where smart money is positioning before New Year’s. One read. Five minutes. Actionable clarity.

If you want to start 2026 from a stronger spot, finish 2025 prepared. Join 200K+ traders who open our premarket briefing, place their plan, and let the open come to them.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

RECEIPTS

American gym membership

Thanks, Orange Theory, but you are still too expensive!

I'm sharing this email from fitness chain Orange Theory because it's the first one I've received about a price reduction in quite some time. (And, FWIW, Orange Theory Bayonne—which I left in Spring 2025 after an income change put its memberships out of our budget—does appear to have lowered prices for all new members as opposed to just me, based on the matching ones currently on its website.)

It also illustrates one of the few remaining moves we have these days if we want or need to pay less for something: Canceling.

See Orange Theory also offering me a second month free, or the discount offers you almost always receive once you stop a streaming membership, or my uncle (so I’m told) recently calling his cable company to cancel service, only to learn that — surprise! — they were just about to notify him that he qualifies for a lower price.

To be fair, sometimes you have to cancel and actually switch providers. (I'm looking at you, State Farm.) But it's important to remember there's still at least one ace in your back pocket.

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

I had tons of insta-thoughts about the (sadly, paywalled) Washington Post article referenced above, but then I realized (1) it's really just a rage-baited, tone-deaf, and outdated argument for trickle-down economics + the dangers of deflation, and (2) the embedded tweet and many others just like it probably say everything that needs to be said anyway.

Also for filing under "did a corporation write this?" A CNBC article argues that "device-hoarding," also known as "holding onto your expensive smartphone until it breaks," is bad for the economy.

This CBS News article had me at the headline — "Personal finance advice doesn't work for most Americans, economists say" — but lost me at "the systems are too complex for many people to understand." I … guess, but also, maybe let's acknowledge that most of today's "money rules," whether understood or not, are just too damn hard to follow?

Oh, look, while I was writing this, the Washington Post reheated Jeff Bezos'(still-very warm) nachos.

JUST A TRAP

And, finally, today, in the "what the hell are we doing here anymore?"

Bleak Friday

Is it just me, or did Black Friday 2025 seem more … full of it than usual this year? Social media was flooded with people peeling back tags to reveal advertised “SALES!" that weren’t actually sales. Michael’s got called out for not having price tags at all (a tariff-related development that, in all fairness, has been going on since Halloween.)

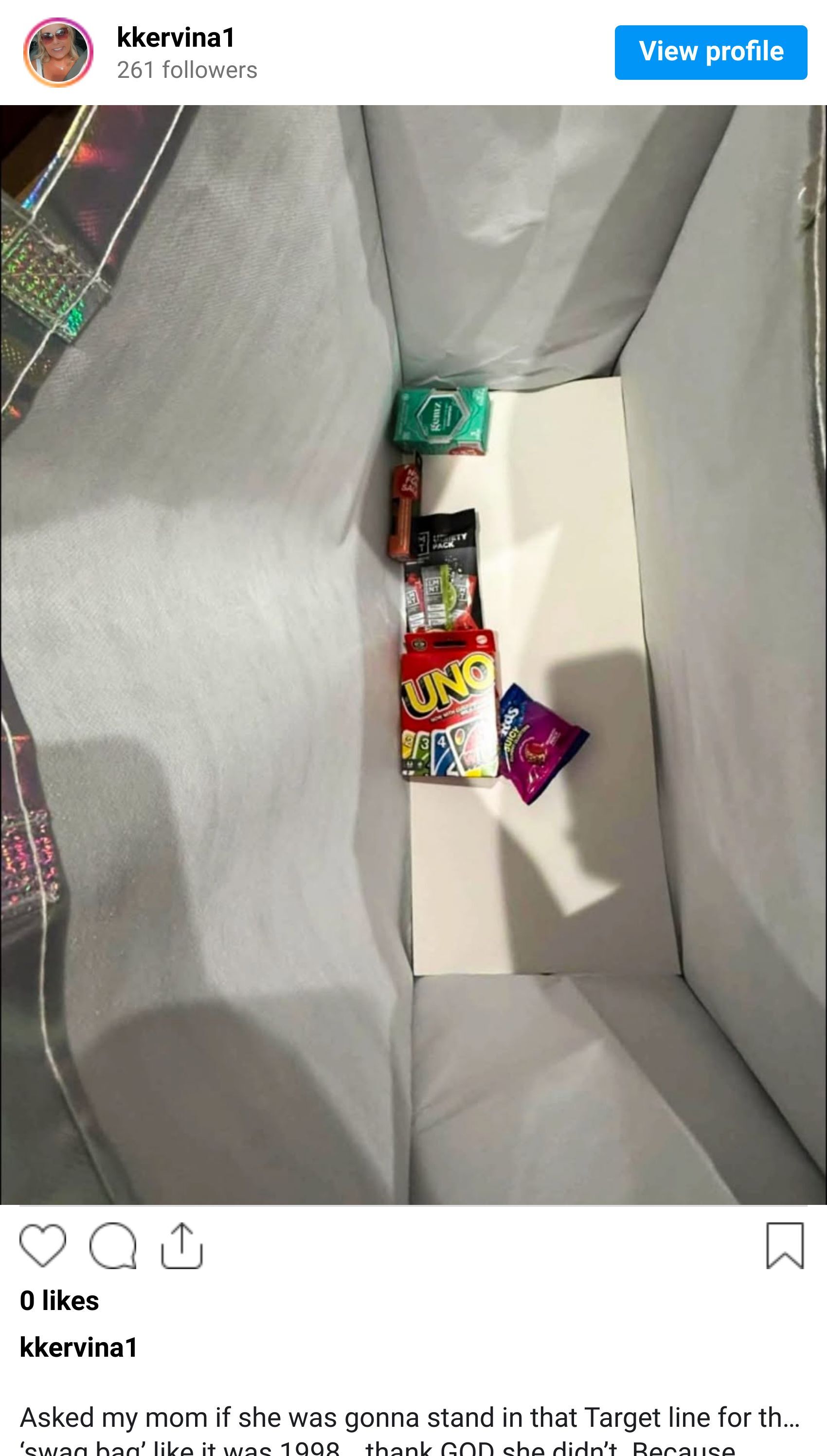

And then there was Target's Swag Bag, one of several high-profile retailer gambits to draw more people to stores that quickly morphed into a textbook lesson on marketing-gone-bad.

Again, is it just me, or would this promotion — which included a chance to win actual gifts — have been at least 13% better received if Target had just MADE THE BAG SMALLER?

To be clear, Black Friday has long been a bit of a con. You can find just-as-good or if-not-better deals on Thanksgiving, Cyber Monday, Super Saturday, Oct. 6, or any other day of the holiday shopping season, I swear. (I've covered the "death of Black Friday" several times during my personal finance reporter career.)

But I mentioned a few weeks ago that I thought we'd be in for a very, very, aggressive holiday shopping season, so consider this your friendly reminder to watch out for and avoid both clear and less obvious marketing ploys, if you're trying not to overpend.

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.