Welcome to Money As If, the financial newsletter equivalent of pulling the last pick at your office's White Elephant.

Today's draws:

Who’s rich anyway?

My $142K not-a-bill medical bill

A (fun!) gift-giving tip

— Jeanine

IN THESE, OUR (POSSIBLE) END TIMES

Do we need to redefine rich and poor?

OK, so, admittedly, I'm a few weeks late to this debate, which started when Wall Street strategist Michael Green (kinda, maybe) suggested raising the federal poverty line for an American family of four from $31,200 to $140,000 given The Current State of Things™️, and got summarily dunked on for having a privileged view of poverty, cherry-picking data, and being bad at math.

But I did have a belated thought to share, which is that, while I wouldn't dare try to redefine poverty (for a variety of reasons, including being bad at math), I do think it's worth considering "who, exactly, is rich?" these days.

Drawing Wealth Lines

Granted, that's hard to debate. The federal poverty level is an objective metric that government agencies use to determine who qualifies for assistance programs, like Medicaid, SNAP, or CHIP. It accounts for family size, geographic location, and the current cost of living by tying calculations to the USDA-determined price of a minimum food diet. It also adjusts for inflation.

There's no analogous definition for wealth, which, even as a word, sounds more open-ended. We can start with median-influenced, income-based percentiles, courtesy of the Tax Foundation:

No. of tax returns | Minimum Income | |

|---|---|---|

Top 1% | 1.54M | $663,164 |

Top 5% | 7.69M | $261,591 |

Top 10% | 15.38M | $178,611 |

Top 25% | 38.45M | $99,857 |

Top 50% | 76.9M | $50,339 |

Bottom 50% | 76.9M | $50,339 |

But these figures don't account for expenses, which are, of course, influenced by region and family size, so the narrative quickly gets hard to follow.

But humor me

Because, OMG, I'm about to do some (admittedly imperfect and cherry-picked) math to illustrate the vibe Green had right before he stepped on the federal poverty line.

Say you're a family of four living in New Jersey that earns just enough each year ($178,611) to be in the Top 10% of Americans. Sounds rich, perhaps, especially the "Top 10%" part, except your monthly and annual expenses look something like this:

Monthly cost | Annual costs | |

|---|---|---|

Mortgage payment | $52,524 | |

Daycare | $22,920 | |

Groceries | $15,972 | |

Car payment | $8,976 | |

Health insurance | $6,850 | |

Student loan payment | $6,432 | |

Utilities | $5,220 | |

Gas | $2,449 | |

Car insurance | $2,304 | |

Cable & internet | $1,560 | |

Clothing | $1,440 | |

Mobile plan | $1,200 | |

Total | $10,654 | $127,847 |

That means a full 72% of your income is going to essential or near-essential modern-day expenses, leaving you with about $51K in, let's say, "more discretionary" spend or approximately 64% of one of Taylor Swift's necklaces.

And that's with me low-balling most estimates. (I'm sure a few parents are side-eyeing the idea that they only spend $1,440 on clothing each year, and, FWIW, our mobile plan for a pair of two-year-old Samsungs costs $296 a month or $3,552 a year.) It's also with me not accounting for sh*t that happens, like emergency car repairs, fun, or, I dunno, your child's braces.

Now, my (fake) family above is, by no means, impoverished, but it's also not quite fair to say they're living large, even if $51K sounds like a windfall, given how mind-boggling little many U.S. residents have to make do with.

And it's easy to see how the parents above might feel like they can't — as the American dream has long promised — "get ahead,” seeing as no amount of budgeting, negotiating, side-hustling, or comparison-shopping is going to make it materially easier to put two kids through college (~$140K, if both go to state schools!), have a two-year emergency fund, and save the requisite $1.2M for retirement.

And I bring this up just because, sometimes, our knee-jerk reaction to stories like this and this or this (OK, maybe not this) is to get mad at each other as opposed to the systemic problems (lack of affordable housing, corporate price-gouging, wealth-hoarding, a completely jacked up health care system) that are increasingly leaving more and more of us behind.

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

RECEIPTS

American health care bills

A quick trigger warning for anyone avoiding anything IVF-related, though this story itself is not really about IVF, as I myself try to avoid that topic, too.

But given that solutions for the U.S. health care system are currently up for debate in Congress, and one high-profile plan includes giving Americans up to $1,500 in a health savings account (HSA) to go with their junk catastrophic health insurance, I felt compelled to share this Explanation of Benefits that I received back in 2023 after about a year and a half of IVF-related procedures.

Yes, you are reading that correctly, the paperwork says I "may owe or already paid" $142,148.70. No, I didn't pay or wind up paying that amount, but that's part of the story.

Good thing I saved $655.89 by (sometimes) staying in network.

After receiving several "claim denial" notices and another Explanation of Benefits that totaled over $200K — apologies, I couldn’t find that one, probably because I ripped it to shreds in a panic or blind rage — I called the fertility center's financing department.

They told me (and, I swear, this is barely a paraphrase): "Oh, don't worry; you don't owe that much money. You only owe what you paid in advance for those services. We bill the insurance company at those prices and take what they give us."

There's lots to unpack here and so little time left today, but to summarize my big takeaways from the experience:

It effectively illustrates the chicken-and-egg conundrum at the center of our current cost of health care crisis: Medical professionals will say they have to rise prices to account for, among other things, insurance company claim denials, while insurers claim they have to raise premiums because medical professionals are jacking up their prices.

Both parties have a vested interest in making a profit, and giving (some) money to patients, as opposed to the insurers who, in turn, pay the hospitals, won’t make that aspect of the system go away.

I didn't owe $142K to the doctor, but I did pay significantly more than $1,500 for care, and, while you could argue that fertility treatment is not essential or life-saving, these prices (and billing practices) apply in those scenarios, too.

There's always a lot of chatter about market-based health care reforms (HSAs being on of them), but you can see clearly here how health care doesn’t operate like other markets or businesses. Some of the items my insurer refused to pay for were never presented to me as a choice — “wear these compression boots so you don't get clots;" "have an extra physician's assist in the OR" — and, if they were, what would I have done anyway? Agree to less care than my doctor recommended?

FWIW, the HSA plan failed the Senate yesterday, as did an extension of the Affordable Care Act (ACA) subsidies, so solutions to our looming health insurance crisis are … still pending. In the meantime, you have until Monday, Dec. 15 to enroll, if needed, in a 2026 health insurance plan. 🙃

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

Not fresh since we've been talking about the weird economy for weeks now, but I appreciate the metaphor: America's job market IS turning into an exclusive airport lounge!

Service-y in a year in which many of us are trying to curb spending: How to budget for holiday tips.

FWIW, quite a few finance sites are hosting debt-free new year giveaways, including NerdWallet and So-Fi, both of which are giving individuals the opportunity to win $100K.

THIRST TRAP

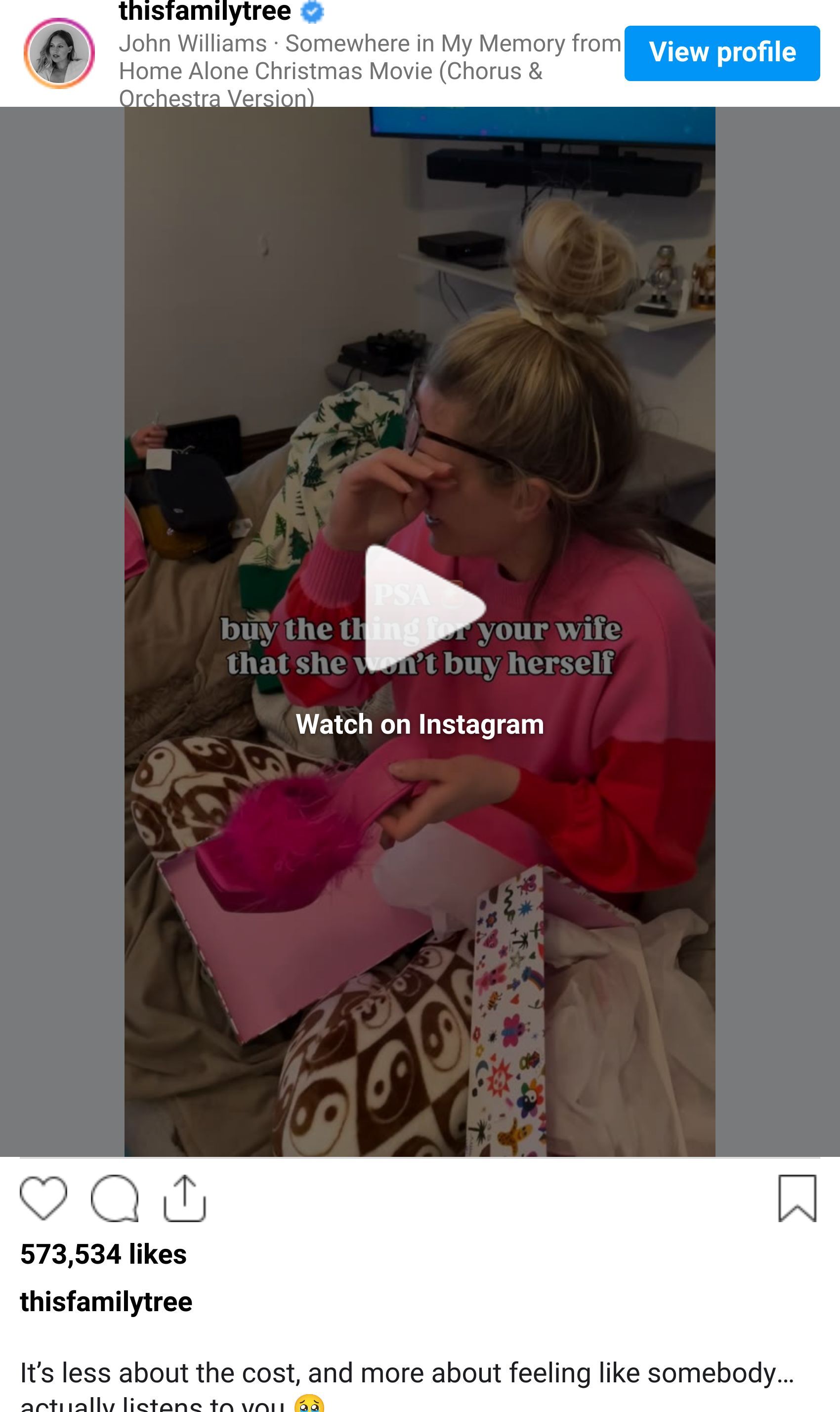

And, finally, today, in things I would buy if I could, you know, just buy things …

Good gifting

Listen, if you've got money for gifts this year (and to end this week's newsletter on a happy note, let's all imagine that we do or will in the near future), this — this! — is the way to give them — namely, buy your loved one something that they are incredibly thirsty for, but will never, ever, ever, based on principle, practicality, or a misplaced sense of shame, buy themselves.

Signed,

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].