Welcome to Money As If, the perfectly toasted toast that pops out of your reasonably priced toaster.

Today's breakfast buffet:

Rethinking retirement at the end of the world

Bravo, Bravo, Bravo

Toast trap

— Jeanine

P.S. Liking Money As If? Share your referral link below!

IN THESE, OUR (POSSIBLE) END TIMES

Should we even bother with retirement planning?

A modern-day financial question posed by a friend, given the increasing threat of climate change. I initially hesitated to tackle it as I suspected the answer would be a bit of a non-event: We can't predict the future with absolute certainty, so we have to financially plan for the long haul.

But then I realized, even without climate change, robot uprisings, or Doomsday clocks set 89 seconds to midnight: We can't predict the future with absolute certainty—and, as the old saying goes, you can't take it with you—so maybe, just maybe, we're too committed to planning for the long haul.

To investigate, I chatted with alternative retirement proponents Derek Coburn and Jordan Grumet. Indulge us for a bit, will you?

The retirement dictum

Personal finance retirement news mainly involves a lot of fear-mongering around how Americans simply aren't saving enough for their happy golden years. But these headlines are misleading, suggests Coburn, author of the forthcoming book Let's Retire Retirement: How to Enjoy Life to the Fullest ― Now and Later.

They're largely predicated on the idea that we'll all leave the workforce between 65 and 70. These numbers were selected somewhat arbitrarily when Germany launched the first national pension program in 1889, and President Franklin D. Roosevelt subsequently signed the Social Security Act in 1935.

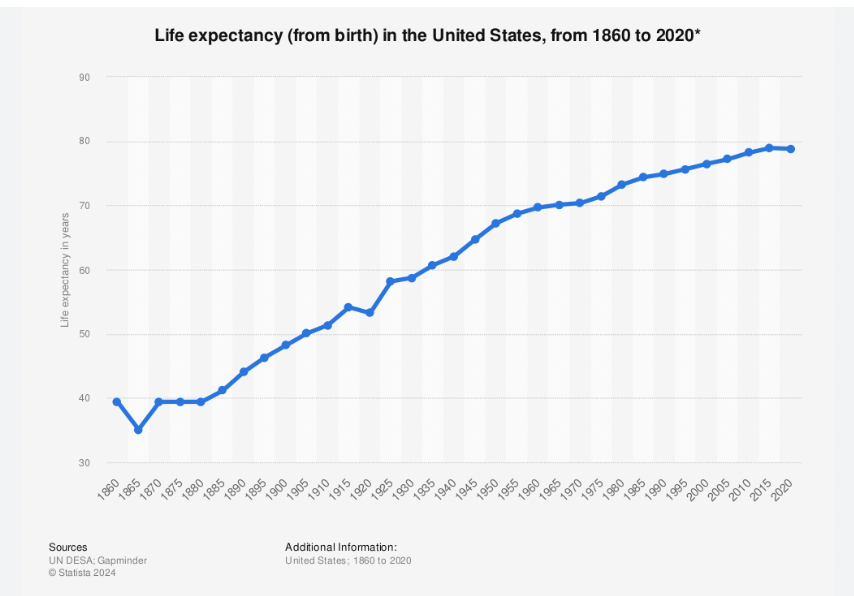

These days, the average life expectancy is 79. When the Social Security Act was signed, it was closer to 61, a full four years less than the appointed retirement age.

These headlines (or, perhaps more aptly, the surveys and studies that spawn them) are also based on assumptions about tax rates, prices, and lifespans in 20 to 40 years.

The odds of getting all of those forecasts accurate "are similar to the odds of winning the lottery," Coburn says — and yet they're often what most influences our financial planning, leads us to prioritize later vs. now, and causes a wealth of worry about the size of our nest eggs.

You are OK, I am OK, we are all OK

It doesn't have to be that way, Coburn says, especially if you're not interested in hanging up your boots the second you're eligible for Social Security.

A long-time financial advisor, he frequently shares this exercise with clients, which illustrates that prolonging retirement by 10 years can reduce their required monthly savings by 96%. (In this example, a hypothetical 45-year-old goes from having to bank $2,390 per month to just $110 per month, based on conventional recommendations.)

Even if you have no desire to work until 75, you might be in better shape than you think. For every three or four studies showing Americans are almost certainly, most likely, or at least probably underprepared for retirement, one suggests, actually, we're doing OK.

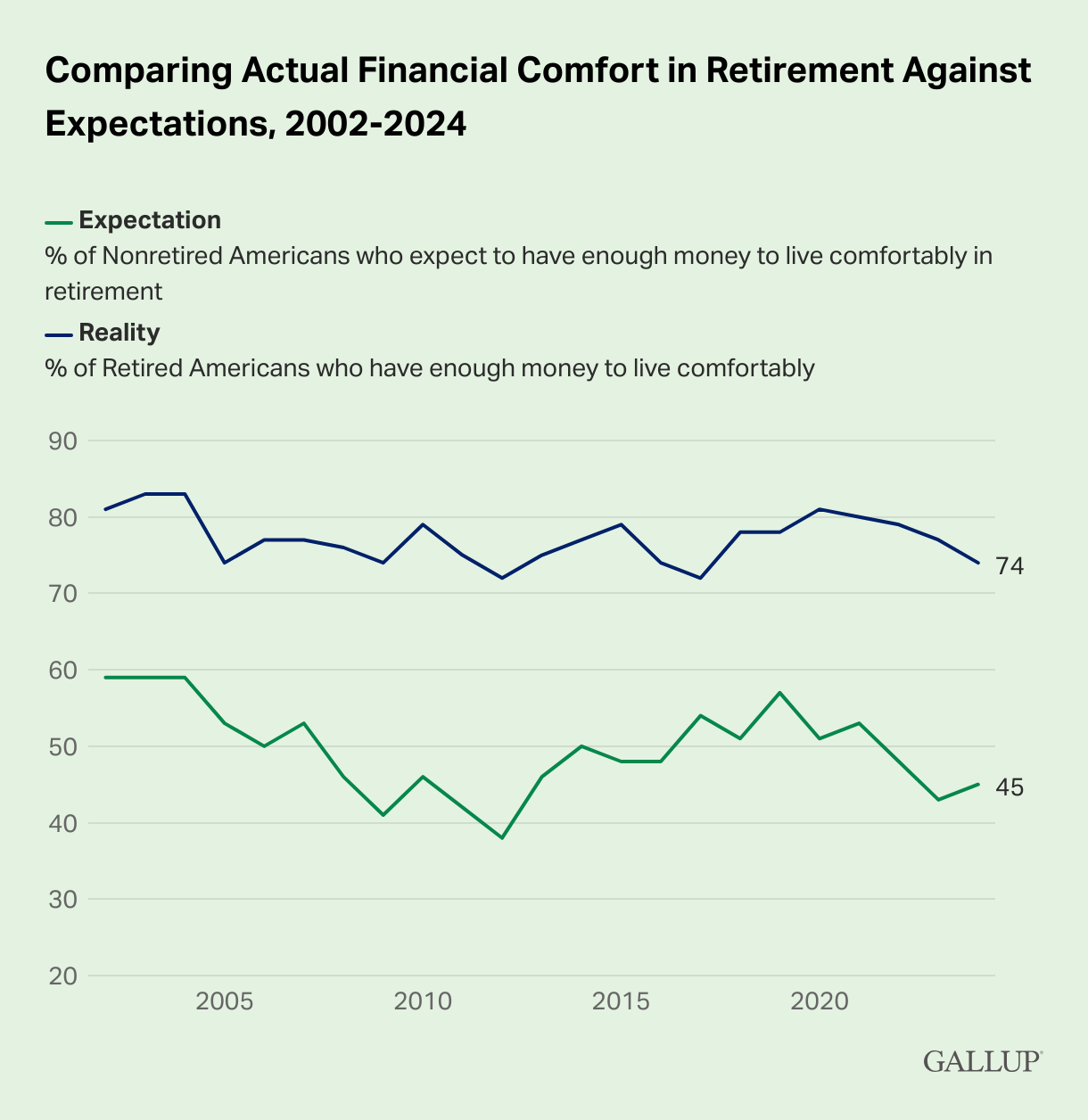

Oh, look, a retirement survey that isn’t terrifying!

See this recent Gallup survey, which found that three in four retired Americans live comfortably. Or this first-person tell-all from Business Insider that illustrates you can enjoy a lengthy, comfortable retirement even after a few financial pitfalls. Or this GoBankingRates study, which found you can retire with $1 million (and sometimes less) in 35 states, despite reports to the contrary.

"If you've been maxing out your 401(k) for 20 years, you're most likely going to have enough to retire," says Grumet, author of Taking Stock: A Hospice Doctor's Advice on Financial Independence, Building Wealth, and Living a Regret-Free Life. In fact, you "might die with too much."

Traditional retirement or … what?

Dying with too much isn't a bad thing, per se, especially if your heart desires to leave your loved ones a substantial inheritance. But it's not ideal when it comes at the expense of a healthier, more meaningful existence, both authors argue.

Grumet wrote Taking Stock after years as a medical doctor reaffirmed what most of us at least subconsciously recognize: That people at the end of their life don’t wish they had worked (and saved) more. They wish they had spent their time doing things that brought them true joy with the people they love.

Following a period of severe burnout, Grumet re-evaluated his retirement plans. Being a doctor "was really joyful for me until it wasn't," he says. Still, "I loved working in hospice." So, he considered the options that would allow him to do so long term, given that one role paid much more than the other, ultimately electing to FIRE.

"I made a lot of money for about three or four years, and then I left," he says, having saved enough to move to a lower-paying but more personally satisfying hospice position.

A different tact

Coburn similarly champions living a more fulfilling life in the here and now vs. the maybe later, citing a key shortcoming of our traditional approach to retirement planning.

"Society has decided that they want us to work the hardest during the time our kids need us the most," he says. (And, even if you don't have kids, long working hours or retirement-imposed financial deprivation is likely impeding your ability to travel, wine, dine, or [insert another big fun thing here] with no guarantee you'll be around to do so in the future.)

Dissatisfied with this arrangement, Coburn restructured his retirement plans so that he works part-time now, with plans to resume full-time work once his 12-year-old and 15-year-old children go to college.

"As soon as my youngest is out of the house, sign me up for 50-to-60-hour work weeks again," he says. For now, "I probably spend an excessive amount of time with my kids."

What does that mean for you?

Everyone's financial situation is different, and it's much easier to accelerate or postpone retirement if you have a high-paying job or a certain level of savings.

Still, while we all need to plan for our happy golden years on some level, we should also feel free to explore alternate paths forward if, for whatever reason, traditional retirement doesn't work for us. Here are a few ways responsible ways to do so:

Assess where you’re at: Having $150,000 in retirement savings at 35 is very different from having $0 at 60. The latter situation necessitates more careful planning, spending, urgency, and, yes, stress than the former.

Assess what you want: Grumet calls this "purpose," and his follow-up book, The Purpose Code: How to unlock meaning, maximize happiness, and leave a lasting legacy, addresses how to find some at length, but what struck me during our conversation was this idea that you don't have to tie bliss to lofty outcomes or thoughts of grandeur. You can simply decide, for instance, that you love reading and then build a financial plan that allows you to do more of it. "You can have goals associated with [your purpose]," Grumet explains, but in these scenarios, "your joy is not associated with [those goals]."

Adjust accordingly. Retiring sooner rather than later, whether for reading, writing, or some other thing, involves a heavy dose of FIRE or other methods that accelerate savings. Retiring later rather than sooner requires certain protections. Coburn, for instance, recommends long-term care insurance, which covers the cost of care for a person with a long-term disability or prolonged illness. He also suggests looking into annuities if you're extra concerned about a guaranteed income stream or maintaining a particular lifestyle in your later years.

Beyond that, I encourage everyone to check out Coburn's and Grumet's books for more actionable strategies on redefining retirement, purpose, and financial planning in the post-pandemic era.

And if you have a personal finance end-of-times question you'd like me to investigate, send it to [email protected].

'Bravolebrities’ edition

I don’t know about you, but Imma blame Bravo if I miss my retirement goals.

📕 $29

The price for a hardcover copy of My Good Side: A Memoir, the forthcoming tell-all from Vanderpump Rules’ Scheana Shay. It’s all publishing (on July 22, that is).

⛱ $49.50

The retail price for a 12-pack of Loverboy spritz, the canned cocktail brand run by Summer House super-couple Kyle Cooke and Amanda Batula.

💎 $176

What I paid for (1) Saturday matinee orchestra seat to see Real Housewives of Beverly Hills' Erika Jayne in Chicago on Broadway back in February. (Totally worth it, IMHO!)

🎿 $199.95

The price of owning an "official" shotski, the drinkware of choice for guests on Watch What Happens, the late-night recap show hosted by Bravo kingpin Andy Cohen.

🍑 $1,000

The starting price for a Cameo from (former?) Real Housewife Kenya Moore, the highest quote from a Bravoleb as of press-time. Granted, Kenya is a former Miss USA — and Gone With the Wind fabulous.

🎲 $1,463.52

The price of a three-day VIP ticket to BravoCon 2025 in Las Vegas, featuring preferred panel seating, early access to reality star photo ops, and priority entry to add-on experiences (separate purchase required).

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

A new entrant in the "how much do we need in emergency savings?" argument, courtesy of Investopedia: $35,000, which would cover about six months of expenses for the average U.S. household.

Ru-uh. Customers are buying now but not paying later for their Klarna burritos.

A good read on how our parents' financial trauma can become our financial trauma, along with some tips on how to break the cycle without tilting too hard in the opposite direction.

TOAST TRAP

And, finally, today, in things I would buy if I could, you know, just buy things …

Speaking of Bravo

I don't frequently toast, but if I did, I'd want it to do so in this $700 two-slice Dolce & Gabbana Smeg toaster, which Jennifer Tilly gifted to Garcelle Beauvais in the most recent season of Real Housewives of Beverly Hills.

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.