Welcome to Money As If, that one singular certificate of deposit offering a 9.5% annual percentage yield (APY) on your savings.

Today's terms and conditions:

What's the purpose of a CD?

ChatGPT is not a nihilist, Skowronski!

Social media makes its Father's Day pitches

— Jeanine

P.S. Liking Money As If? Share that referral link below for a chance to earn some swag!

IN THESE, OUR (POSSIBLE) END TIMES

Are CDs pointless?

I've seen quite a few articles hawking certificates of deposit (CDs) recently, and while I get the sales pitch on one level — the Federal Reserve is probably gonna lower rates soon, so maybe, you should lock in that annual percentage yield (APY) right now! — on another level, I … don't.

In fact, I could never really get into CDs as a financial instrument. And I’ve tried quite a few times, given I’m one of those people who tend to keep too much money in traditional savings.

Sometimes, the math is just not math-ing

For starters, the current returns on CDs aren't very lucrative. Yes, a few credit unions offer APYs of 5% or above, but these CDs have heavily restricted audiences.

To get California Coast Credit Union's flashy 9.5% APY celebration certificate, you must live in Orange, Los Angeles, Ventura, Imperial, or San Bernardino counties. And only North Carolina volunteers or government officials can qualify for Civic Credit Union's 5.5% APY choice certificates.

The best deals on no-strings-attached, easy-access CDs generally cap at around 4.5%, which means you've got to deposit a significant amount of savings and keep them in the CD for a long time before making any money.

Say you put $100,000 in a 12-month, 4.5% APY account. At the end of the term, you'd net $4,500. That's not nothing, but it's also not too far off from what I'm currently earning on my high-yield savings account (3.65% for an annual net of $3,650), and with that account, I don't have to worry about early withdrawal penalties. (These vary by length of the CD but typically involve 90 to 365 days worth of interest.)

Say you put $100,000 in a 60-month, 4.5% APY account. At the end of the term, you'd net $24,618, which feels significant, but I dunno; I'm certainly not wealthy enough to lock $100K away for five years, with or without the risk of early withdrawal penalties. Plus, there are seemingly more lucrative places — like a 401(k) or individual retirement account — to park that money.

It wasn’t always this way

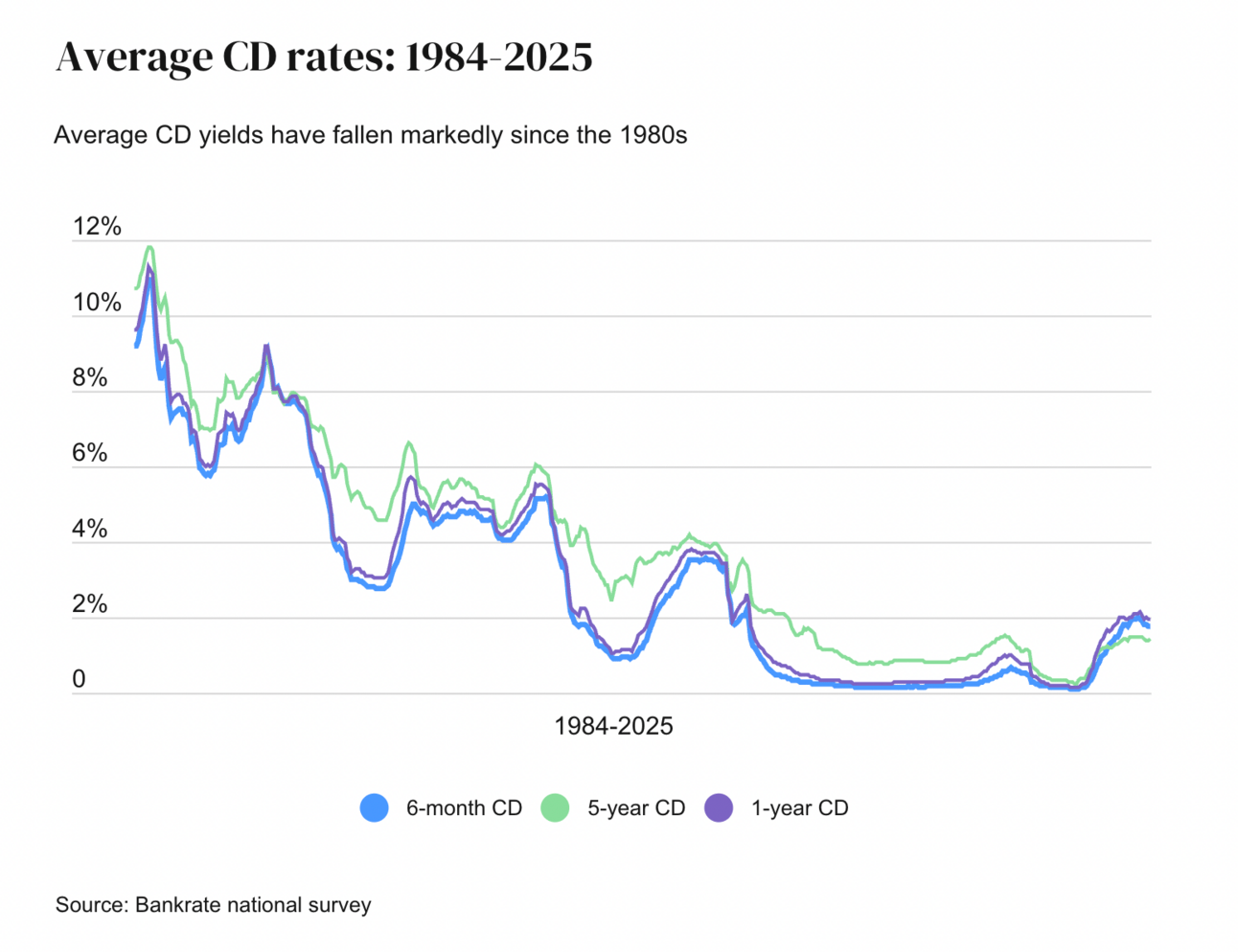

CDs used to be a much more reliable wealth-builder. In fact, back in the 1970s and 80s, banks offered rates on these well in the double digits. For instance, in 1984, the one-year average CD yield was 11.27%.

Put $100,000 away in that scenario, and you'd net $11,270 at the end of the year. (Granted, people were still recovering from back-to-back recessions in 1984, and most weren't banking $100,000 in a 12-month CD, but you get the appeal.)

After the Great Recession, CDs pretty much flatlined, and while rates right now are certainly better than the 0.14% rate you could get in the wake of COVID-19, they have yet to come close to prior peaks.

So why are CDs still popular-ish?

A few things — one being something that I was admittedly trivializing (just a smidge!) before. When the Fed inevitably lowers rates, CD rates will drop, for sure, but so will the APYs on high-yield savings accounts.

In fact, the APY on my high-yield savings account has fluctuated between 0.5% (!) and 4.5% since I opened it in 2019.

Most CD rates are fixed — meaning the bank can't lower them during the term, no matter what the Fed does. So, to avoid getting played on your savings, you might consider the less-liquid account. (I’ve yet to feel the earnings-to-liquidity value on a CD was quite right to do this, but, as with everything we talk about here, that's just me, and, at a certain level of savings or for the right offer, I’d likely change my mind.)

When CFPs recommend CDs

Something I was thinking less about that a few certified financial planners (CFP) flagged when I solicited them for advice: CDs are particularly useful if you have a specific spending goal and don't want to risk losing money on the funds you're banking.

"For instance, a client that wants to buy a house in one-to-two years can invest in shorter-term CDs to earn interest on their savings while still making sure their principal is protected," says Brett Lozowski, National Association of Personal Financial Advisors (NAPFA) advisor bureau member and investment manager at Life Planning Partners.

Similarly, CFP Meredith H. Schneider recommends CDs to clients who sell securities, have a taxable event, and need to pay tax on any capital gains.

“A CD will not necessarily provide the highest return, but it provides a return for a short period of time, and the funds will be available and reliable when the bill comes due," Schneider, registered investment adviser at Schneider Wealth Management, says.

Here are a few other tips I gleaned about when and where to tap CDs:

They're an option for a hyper-conservative investor "who can't stomach the market and is willing to give up return potential to have principal protection," says Anne Ward, NAPFA advisor bureau member and founder and principal wealth manager of Wisdom Wealth Management, LLC.

You can access those funds if you need to. You'll face the penalty, but, in most cases, you're simply forfeiting interest, not principal. Plus, "if you purchase a CD at a brokerage, you have the potential to sell the CD before it matures," Schneider says. "There is a risk that you sell it lower than the amount you put in, but also a chance that you sell it higher." And, in either instance, you’ll have access to emergency funds.

They work well when laddered. That's when you buy several CDs with staggered maturity dates. "For example, if you wanted to set aside six months of living expenses in case you lose your job, you might split that across six CDs that mature every two months," Ward explains. "When each CD comes due, if you don't need it, you buy another one-year CD, so every other month, there is money available to help with emergencies."

So, OK, CDs, I see your value now.

RECEIPTS

ChatGPT’s got retirement hopes

This probably won't surprise you, but I'm not really into asking ChatGPT for advice on personal finance. Sorry, not sorry to this robot, but it mostly regurgitates the Internet, which means it won't tell you anything you haven't heard before.

Case in point, here's its response when prompted for its best personal finance advice:

ChatGPT also told me to avoid high-interest credit card debt, invest early and often, track my spending, learn continuously (fine), and define what ‘rich’ means to me.

I was interested, though, in how it might handle an end-of-the-world personal finance question, given that, you know, an apocalypse hasn't happened yet. So, I ran my last hot take by it: Considering climate change, should we even bother saving for retirement?

And, while I figured it would tell me, "Yes, because there's no guarantee the world will end" (which it did), I was surprised that it thought to mention — and caution against — nihilism.

“Retirement planning is not just for a utopian future; it's a hedge against uncertainty." — ChatGPT

It also suggested I speak to "a climate-aware financial planner, or even a therapist" if I was paralyzed by climate anxiety.

Now, granted, I was being a little messy. The exact prompt that generated this response was: Should I save for retirement, given the world may end due to climate change? So maybe this lecture (or concern?) was deserved.

In any case — and I can’t believe I'm about to say this — I didn't hate its actionable advice about what you can do if mulling this question. The tips included a mix of financial and climate-centric advice, like:

Values-based investing: Promote environmental, social, and governance (ESG) causes by buying stock in companies devoted to renewable energy and clean technology while avoiding stock in companies that, you know, make and sell toxic waste.

Personal energy efficiencies: Make household changes that can help the environment, such as installing solar panels, wood-burning stoves, and energy-efficient light bulbs.

Resilience assets: Diversify your personal and financial portfolio by investing in land, community (local food systems, farming networks, preservation groups), and trade skills (first aid, carpentry, repair work).

OK, ChatGPT, I see your value now thanks for the second opinion.

'Stuff Meta wants me to buy my dad' edition

Friendly reminder: Father’s Day is June 15.

🍫 $36

for a case of six chocolate cigars from the persistent chocolatier Cacao & Cardamom. Available in liquor-inspired or ballpark-treat-inspired flavors.

🥓 $69

for a bacon bouquet from Manly Man. Co. I'm assuming the price tag is a dirty dad joke, but considering the beef jerky bouquet costs $70, I can't be sure.

🧭 $206.55

for a medium-sized 3D wooden map of J. R. R. Tolkien’s Middle Earth made by wooden memento maker ZeWood. For the geek dads, of course.

🍳 $445

for a non-toxic 12-piece Caraway cookware set, which includes a frying pan, sauté pan, saucepan, and Dutch oven. One of the few Dad-promoted gifts in my feed that didn't feature bacon. booze, or other stereotypical dude stuff.

🛢 $1,449

for the Jack Daniel's Master Distiller Bundle, five watches made from reclaimed whiskey barrels from the popular distillery. Expensive, but kinda cute?

🏷 $3,100

for an 18K yellow-gold Chevron tag by David Yurman, set with 0.80 carats worth of black diamonds. Love you, Dad, buy LOLZ!

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

The housing market is kind of changing in that inventory is high(er) and prices are starting to come down. No movement on mortgage rates or climate-change-influenced insurance prices, though.

Gen Z is money dysmorphic.

It's probably not surprising, given that just last week, I mentioned that Costco was introducing a "Buy Now, Pay Later" program, but a new survey finds four in 10 Americans are financing groceries.

THIRST TRAP

And, finally, today, in things I would buy if I could, you know, just buy things …

Good egg

I’m not the biggest yellow-gold (or egg) fan, but this kitchen accoutrement caught my eye.

Behold: The Christofle Mood Cutlery Egg, a 24-carat, 24-piece flatware set apparently beloved by the Kardashians — probably because it costs $20,700!

Veruca Salt would die. Or live? Or both, maybe?

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.