Welcome to Money As If — and happy new year! May we all end 2026 in the best financial shape ever. On that note, today's auld lang synes:

Money resolutions in a time of financial nihilism

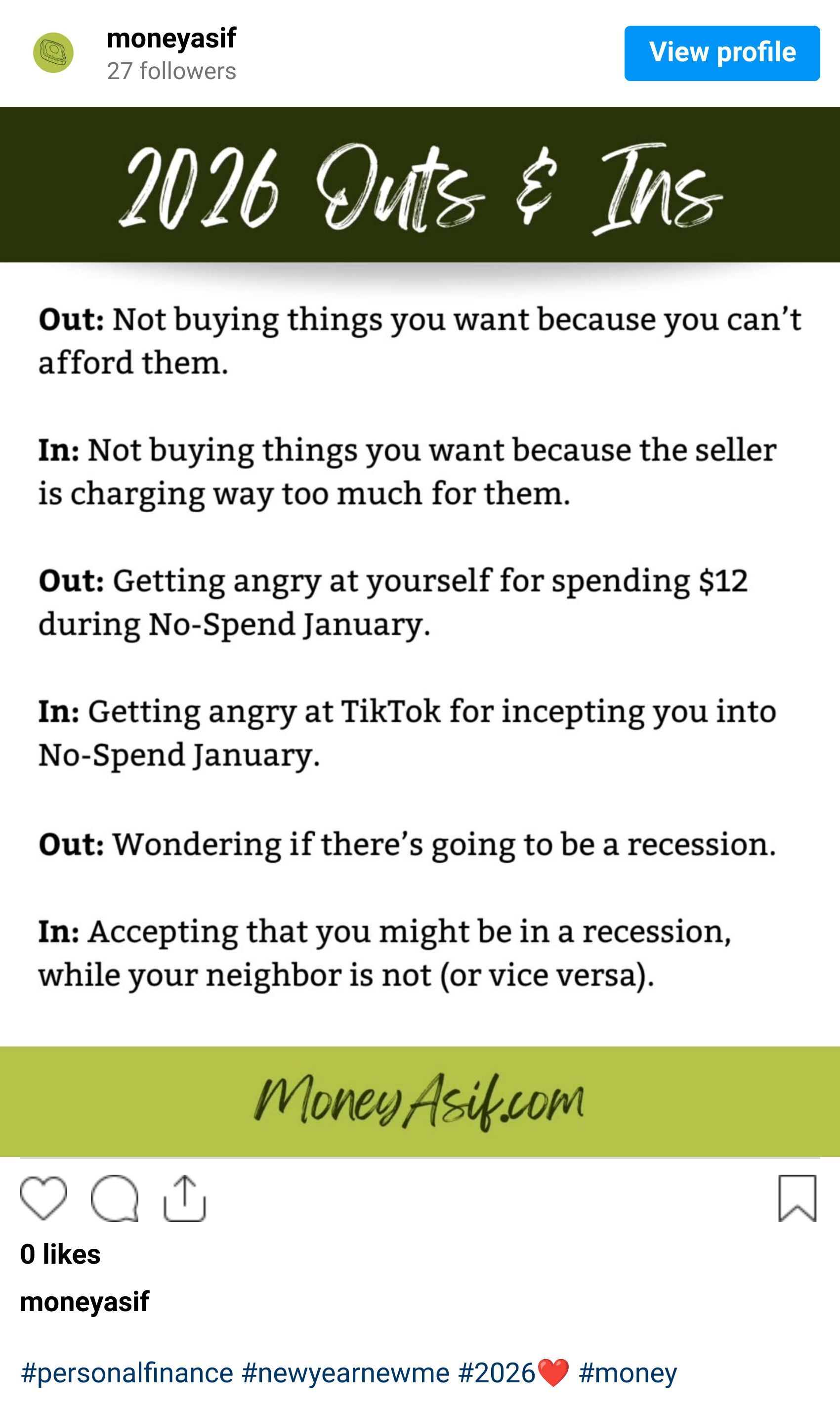

2026 ins and outs

One of my favorite things

— Jeanine

P.S. Liking Money As If? Share that referral link below!

IN THESE, OUR (POSSIBLE) END TIMES

Why bother with money resolutions?

Since at least COVID, my instinct has been to declare most "old-school" personal finance advice — in this case, "have a New Year's money resolution" — D.O.A. That's admittedly because, as someone who's covered the industry for over 15 years, I find the topic boring and obvious, and the advice to be patronizing and always the same:

Assess your financial health!

Create a new budget!

Pay down high-interest debt!

Build an emergency fund!

Save more for retirement!

Cut back on discretionary spending!

Have an accountability partner!

It's also because a lot of these resolutions normalize certain money philosophies that I wish we could all de-normalize in 2026 and beyond. "Cut back on discretionary spending," for instance, suggests it's a bad habit or perhaps even a moral failure to want things beyond food, shelter, and water. (It's not.)

"Create a new budget" reinforces the idea that we can all simply spreadsheet and discipline our way to a better financial life. (We can't and, quite frankly, shouldn't have to.) "Have an accountability partner" risks spreading a systemically imposed toxic relationship with money. And on and on and on …

But

There's something I've been struggling with ever since the economy went full K-shape, which I first mentioned in our last issue: These days, there's an increasingly stark contrast between the way things are and the way things should be.

We shouldn't have to, say, stop eating breakfast to save more money, but that doesn't mean, in a time of tariffs, inflation, and AI-enabled dynamic price-gouging pricing, we don't need to find (other) ways to spend less on groceries.

We shouldn't have to "learn AI" to keep AI from taking our jobs, but that ignores the fact that there are tons and tons of job postings for AI Research Scientists, AI Content Editors, AI Engineers, or AI [Insert Your Job Title] here.

We shouldn't have to choose between spending $43,000 a year on premiums and going without health insurance, but that doesn't change the current price tags for coverage. And on and on and on.

Plus

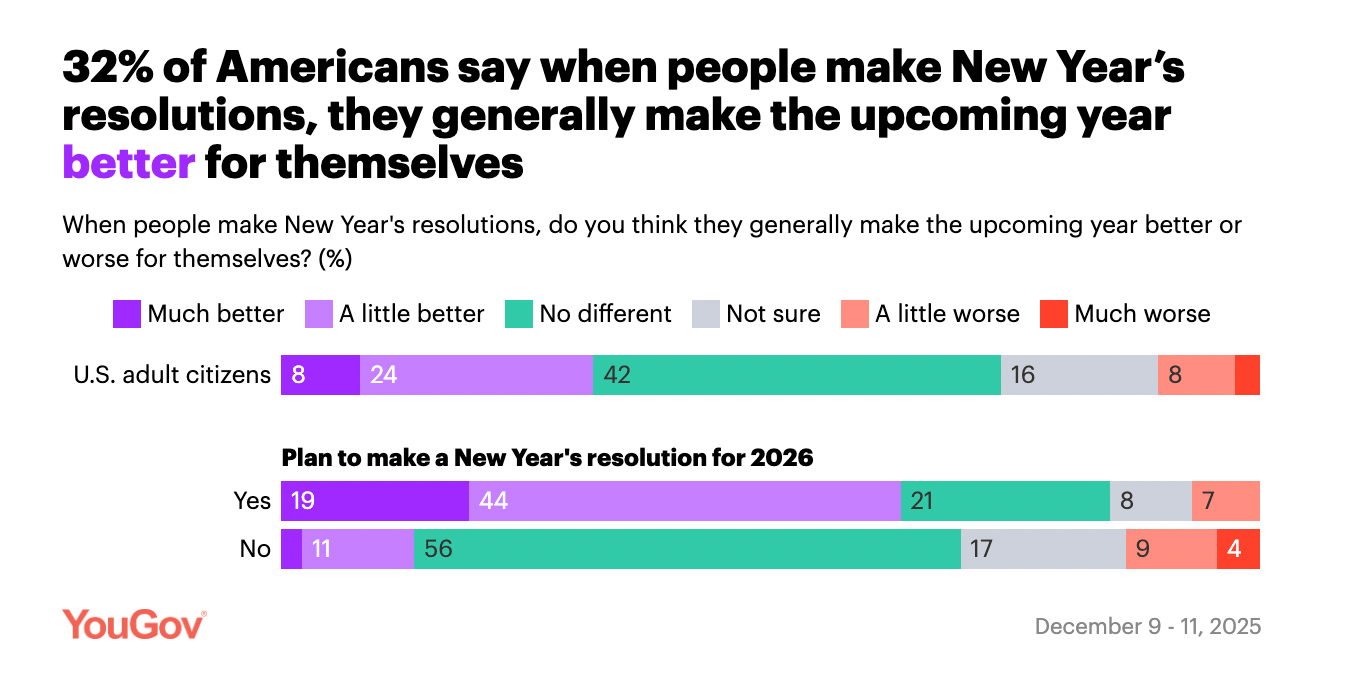

There's plenty of evidence to suggest that people benefit from getting the new year off to a good start.

32% ain’t nothing!

And, while I totally understand and sympathize with the pull toward full-on financial nihilism, Kalshi is not the answer. (Let's bookmark this for further discussion.)

Plus, you can save more money or otherwise improve your financial health if you carve out some time for (albeit annoying or even infuriating) tasks, like re-shopping for car insurance, that are particularly and absolutely worthwhile if money is a top concern heading into 2026. (I refuse to frame this as "make an effort," because I know most people, and especially those reading a financial newsletter, are.)

So, call me pro-financial resolutions

But let's not go overboard, OK? Because these things only work if you follow through, and, unfortunately, the go-to money promises we tend to make at the start of a new year are easier said than done these days.

For instance, having an emergency fund is a good idea; mandating that you save enough to cover the now-recommended two years' worth of expenses can lead to all sorts of unintended consequences, like missed investment opportunities, accidental credit card debt, or ripping the hair from your head.

So, in the interest of reaping the true benefits and actually saving a dollar or two, might I suggest going more tactical than conceptual this year? In other ones, pick one, small lingering money move you know you can make and potentially build off of, like:

Re-shop for car insurance!

Consolidate all 13 of your old 401(k)s!

Buy life insurance!

Negotiate down or even eliminate that ridiculously expensive medical bill!

Cancel your least favorite streaming subscription (or that one big thing you're no longer using)!

Open a high-yield(ish) savings account!

Get the will you got back in 2019 actually notarized! (Not a real story, don't worry about it.)

Set up auto-pay to save on your utility, cable, or Internet bills.

That way, we don't set ourselves up for a financial failure that's not entirely our fault.

BTW, that last one is a true story and something I did entirely by accident on Dec. 31, after Optimum notified me that our current payment method had expired and I had to (annoyingly) contact them to update it. Turns out, we could save $10 a month by auto-paying via a linked checking account, and NGL, it felt good to start 2026 off by shaving $120 off our annual expenses.

CHEAT SHEET

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

You guys, you'll never guess which brand Wirecutter named "the best vodka of 2025." (Well, maybe you will.)

Job market so weird, people are using dating apps to find work.

A fun, fresh take on year-end "best of" round-ups and the perfect encapsulation of consumerism in 2025, I give you Vulture’s Bucky Awards, which celebrate the best, worst, and most expensive popcorn buckets of last year. ($80 to hold a giant light-up Galactus head while you watch Fantastic Four? I suppose there are worse ways to spend your money.)

GOOD TRAP

Plug of the month

And, finally, today, in things I have bought when I could buy things …

I’ll take it!

Lord knows I love to call out a bad marketing ploy, but you know what? I'm also happy to call out a good one. Case in point: This surprise "perk" in my December Book of the Month Club box — i.e., free wrapping paper and the opportunity to "gift" its recipient with a free first book from the subscription service.

Yes, of course, this is a play for new customers, but a free book is a free book and I've long been a happy Book of the Month subscriber (not a paid endorsement) as it provides reliably good customer service and nice perks for loyal members, like a free book on your birthday and another at the beginning of each year when they select a Lolly winner.

Plus, the copywriting on their bookmarks is top-notch.

P.S. As of the time I'm sending this newsletter, that's an active label, so if you're genuinely interested and can afford Book of the Month, have at it.

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.