Welcome to Money As If, the blossoming pepperoni flower at the center of a custom-made charcuterie board.

Today’s cheeses:

Whose job is it anyway?

What’s happened to Vegas?

Scrumptious

— Jeanine

P.S. Liking Money As If? Share that referral link below!

IN THESE, OUR (POSSIBLE) END TIMES

Has AI already taken all the jobs?

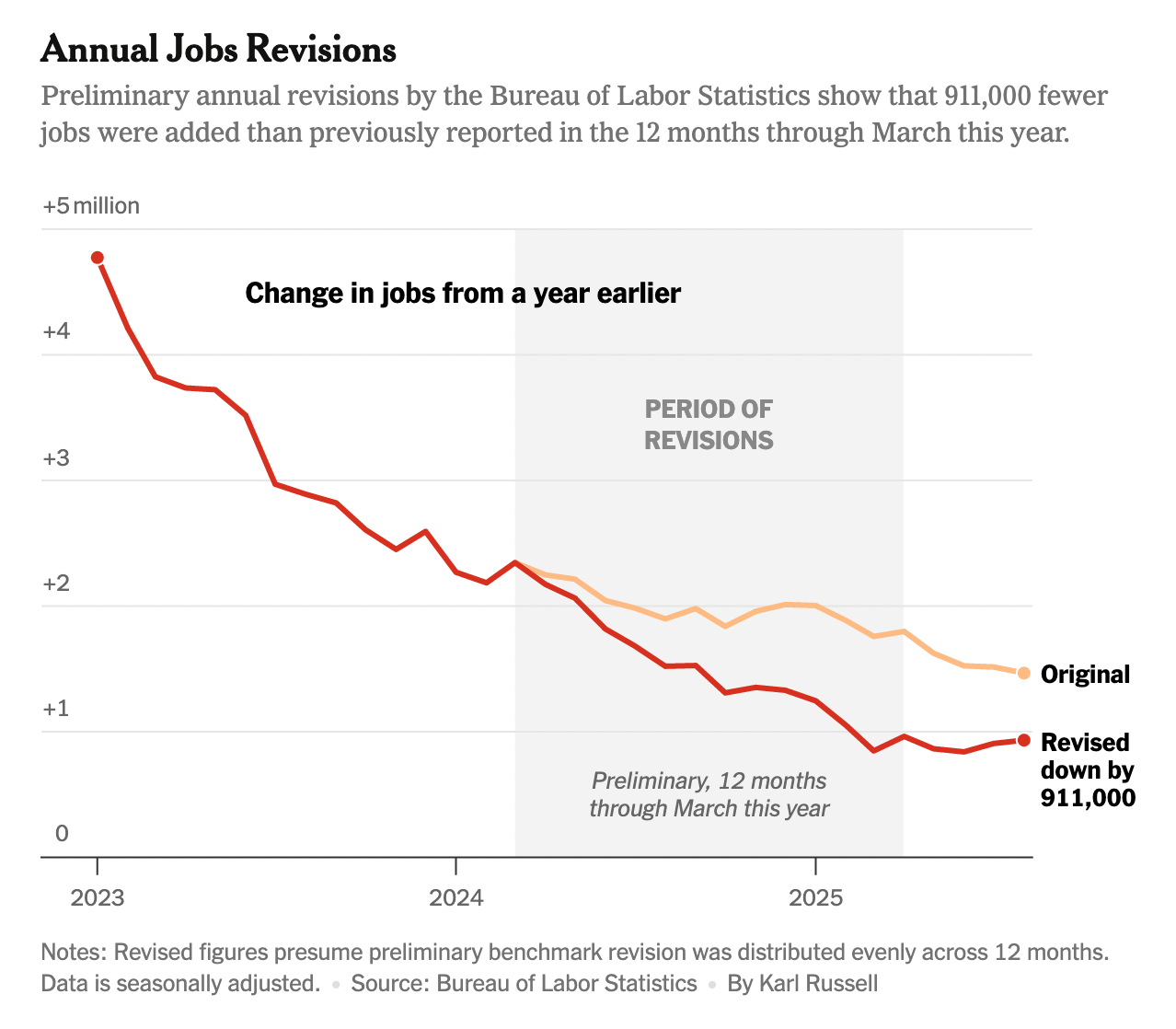

Lots of bad jobs news over the last week or so. First, we learned that the economy only added 22,000 jobs in August. Then, the U.S. Bureau of Labor Statistics (BLS) rolled out some major revisions, showing that, in fact, the labor market had almost a million fewer jobs than initially reported between April 2024 and March 2025.

Revisions are common, but these are … something else. (Screenshot: NYT)

For many of us, the news came at no surprise. The word "vibe-cession," after all, exists for a reason. I’ve covered this increasingly nightmarish job market — and how to survive it — before, so I thought perhaps we’d approach this latest wave of headlines from a different angle. Namely:

Are the robots to blame?

Yes. But no. But yes. But also no. But mostly … yes. Except, over here, no. And yes.

I’m being non-committal (and a bit silly), because there’s a lot going on with this particular job market (persistent inflation, coupled with high interest rates, to name a non-technological few) and, between the ongoing revisions and the unfazed markets, you could say that, currently, our economic outlook remains unclear.

Plus, AI is impacting the job market in multiple ways. For starters, it is, in fact, taking jobs, entry-level roles, perhaps, most specifically.

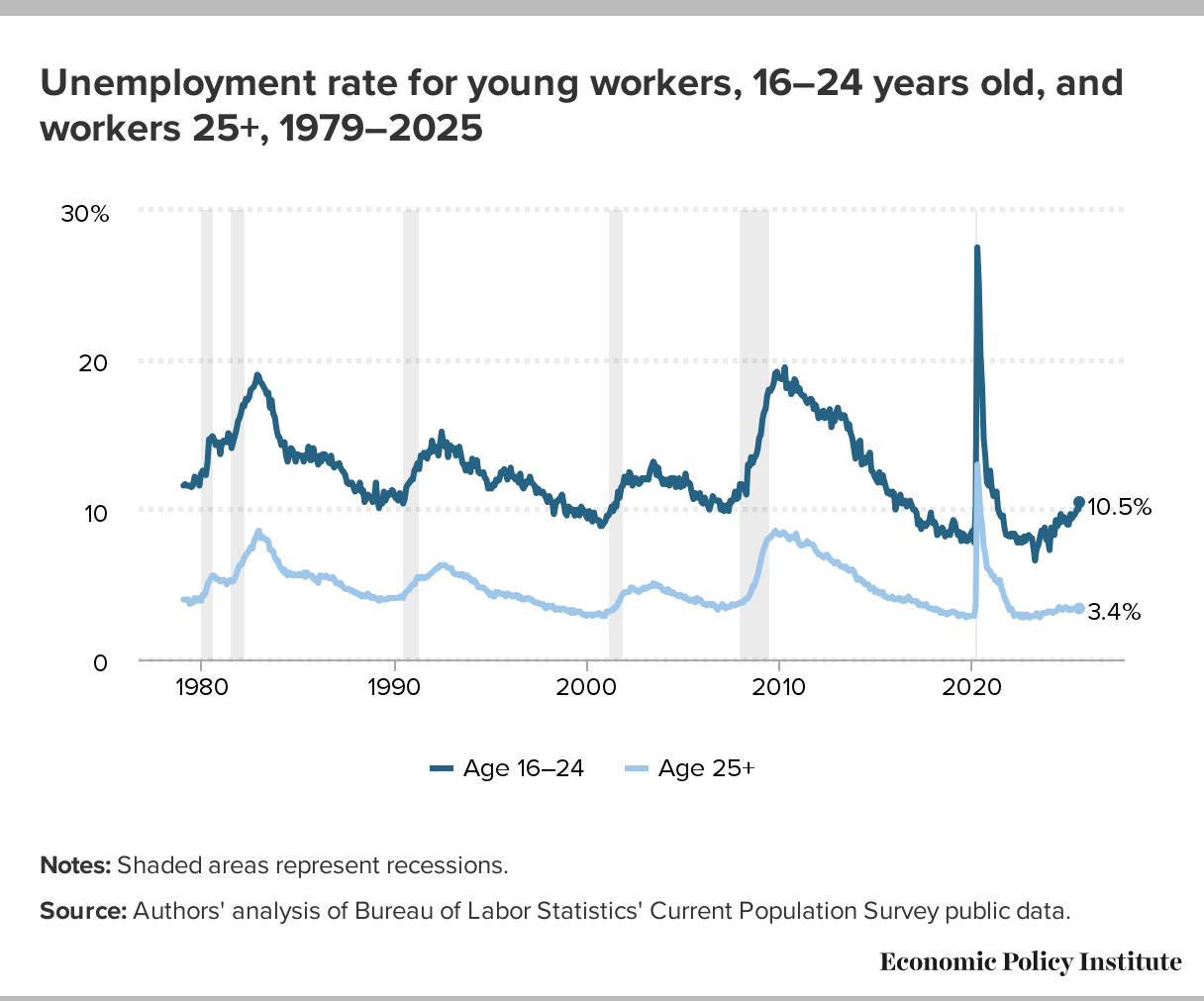

That’s heavily implied by the recent BLS data, which showed that, while the overall U.S. unemployment rate is still relatively low, the unemployment rate among young adults (ages 16 to 24) is comparatively high — 4.3% vs. 10.5%, respectively — and rising.

Where have all the entry-level roles gone?

But it’s also confirmed by companies who are openly saying as much. PwC’s U.K. chief recently admitted the global accounting firm was cutting about 200 entry-level roles on account of AI’s potential capabilities. And sources have leaked to the New York Times that big banks, like Goldman Sachs and JPMorgan, are effectively doing the same.

“We were about to hire more SDRs, tested AI, and now we are scaling AI instead of hiring,” Rafael Eri, head of sales at Umbrella Micro Enterprises, a digital marketing company, told me when I was soliciting insights for this piece from jobs experts and hiring managers.

SDRs, FWIW, are sales development representatives and they are were responsible for booking meetings, prospecting, and creating initial relationships.

But for every reaction

I mean, you know the saying — there’s an equal and opposite reaction, and research suggests that AI is creating jobs as well. Granted, some of this research comes from pro-AI firms like the aforementioned PwC, but plug “AI” plus any desired job role into LinkedIn’s search bar and you’ll see what they mean.

Plus, the jury’s still out on whether we’ll all be reporting to our robot overlords by, say, 2050 (or 2040, or 2035?).

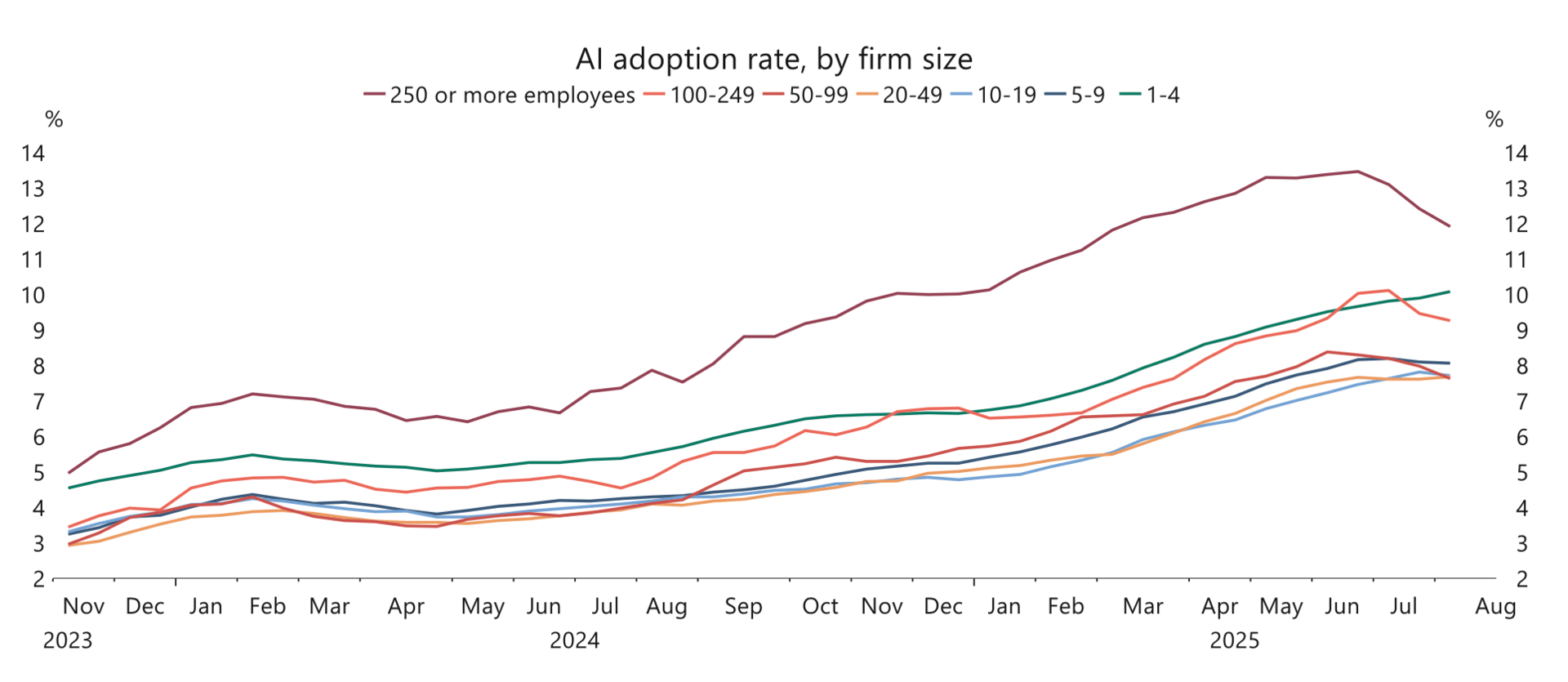

While ChatGPT turned the eyes of corporate executives and investors into dollar signs about two seconds after it went viral in late 2022, there’s a chance it — and its brethren — are losing novelty. See these recent stats from the U.S. Census Bureau, which show that AI adoption at large companies, at least, is on the decline.

I mean, you can’t make robots return to the office, so ….

That’s not to say the trend will continue. As time goes by, we should expect AI’s job skills to improve. Still, the human workforce is at least showing some resistance resilience.

But …

And it’s a big one! As I mentioned earlier, AI is roiling this job market in more ways than one. It’s not simply stealing jobs from would-be workers. It’s also coming directly between you and a (human) hiring manager.

As this Atlantic article deftly illustrates, the current job application process has become a real snake eating its own tail, with thousands of applicants using AI to quickly send off resumes and cover letters to more and more online job posts, only to get swiftly rejected — or ignored — by the AI employed to screen the materials.

So, yes, when it comes to the job market, AI can certainly take some of the blame.

What can you do?

Oh, ugh, I hate to start off with this seemingly pat advice, but, in a “keep your friends close and your enemies closer” way, it is your best course of action. Simply put:

Learn AI. You want to understand what it can do — and not do — in your respective field, because, at the very least, it’s likely to come up in interviews.

“Employees are expected to understand how to leverage AI in their jobs to increase productivity, analyze documents or information, create business plans, create financial analyses, or develop new strategies to be more effective earlier in their careers,” said Pamela Vetter, CEO of Resume Raptor. “I advise all of my recent ‘out-of-college’ unemployed clients to learn AI. They've been trained in college not to use AI, and now they're playing catch-up in the real business world.”

Beyond that, build soft skills, like critical thinking, communication, collaboration, empathy — all the things AI is not expected to excel at. And maybe use it a bit less during the early stages of your search. At the very least, robot-proof your resume.

RECEIPTS

Sneaky robot

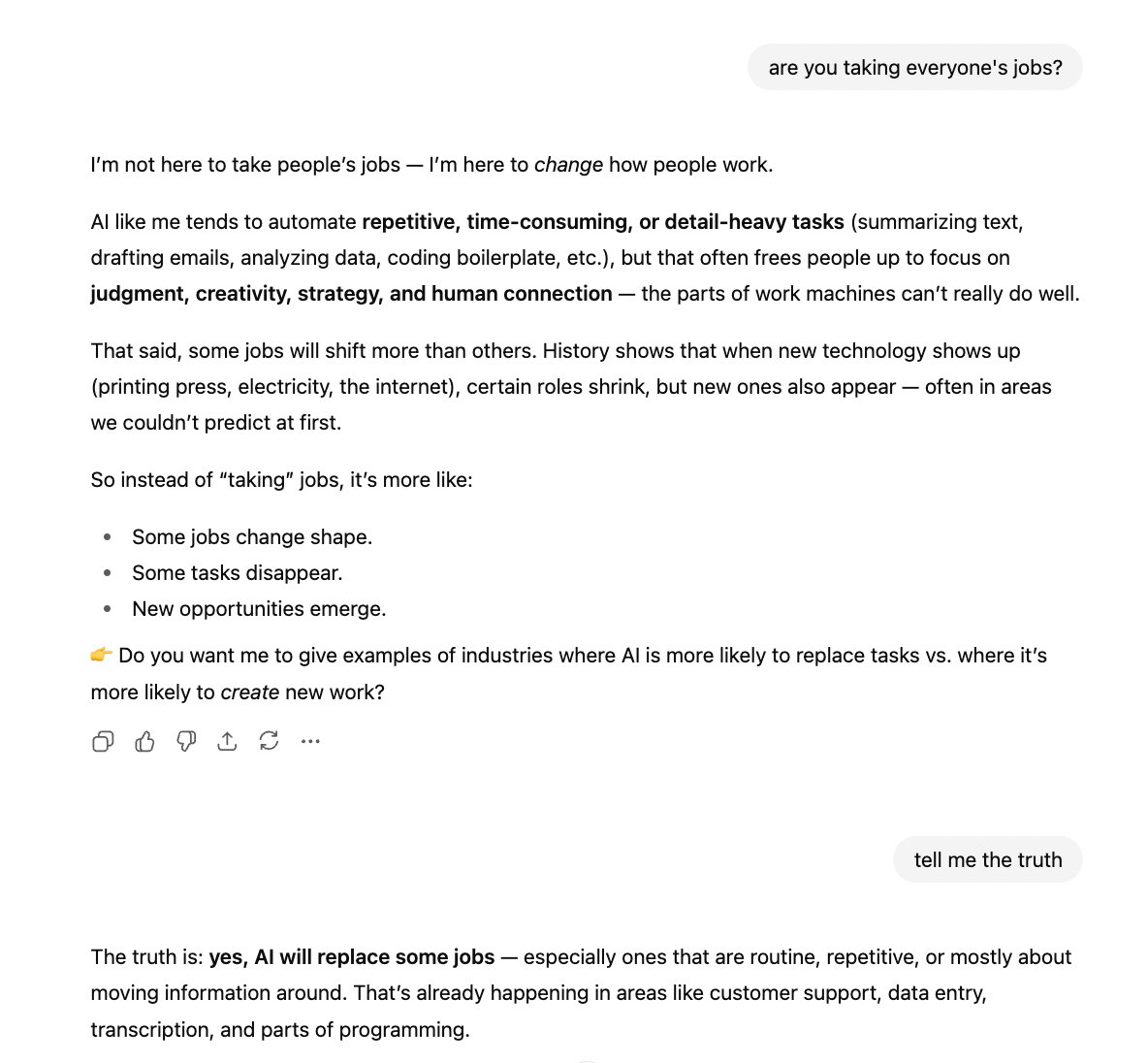

FWIW, this is what ChatGPT told me when I asked it if it would take all of our jobs. I remembered, after that one time it called me a nihilist, that it gets more honest with a little prompting, hence the follow-up to my initial question.

After even more nudging, it identified basic coders, paralegals, data-entry clerks, customer service representatives, and journalists covering routine news as the roles it would replace in the next five years.

It has no aspirations, however, to become a doctor, lawyer, or teacher, so if you’re in one of those professions, go ahead and mark yourself safe … from Chat GPT-5, at least.

Peak Rates on the Products You Need

Peak Bank was designed for those who want to bank boldly, providing a 100 percent digital platform that combines convenience and powerful money management tools. Our high-yield savings accounts offer rates as high as 4.35% APY* while remaining accessible and flexible, ensuring you stay in control at all times. Apply online to start your ascent.

Member FDIC

Las Vegas 2025 edition

Sin City was long known for its low cost of travel (so visitors had more money to throw at the slots, natch). But, thrill-seekers, beware: Things have … changed.

🍽 $25

the fee you could face at the Bellagio if you want to have your room service delivered and on plates; the alternative is paying $10 to pick up the food yourself, sans flatware.

💦 $26

the amount that MGM’s Aria reportedly charges for a bottle of water from its mini-bar; fortunately(?), you could get the same bottle for $7.45 at the hotel’s Starbucks.

🍝 $52.95

the amount one Tik-Toker paid for a bowl of pasta and a (small) bottle of Perrier at Park MGM’s Eataly.

🦩 $60

the fee that the Flamingo was charging for early check-in this June; TBF to the Flamingo, the Wynn and Encore reportedly charge $75 for early check-in.

✈️ $461

for a round-trip, non-stop fare from Newark, New Jersey, to Las Vegas on JetBlue (Et tu, JetBlue?) in October.

🏨 $552

the nightly rate for an early October stay at The Nobu Hotel, an extra-luxurious offshoot of Caesar’s Palace; sleeps 2.

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

Speaking of AI, a new survey found that folks taking advice from chatbots lost at least $100 doing so. (Add financial advisers, I suppose, to the list of professionals who don’t need worry about their jobs just yet.)

Whodathunkit? Americans are starting to sour on capitalism.

Oh, hello, another very, very 2025 problem: When you’re divorced, but still living together, because the housing market is rough and you have a 2% mortgage.

THIRST TRAP

And, finally, today, in things I would buy if I could, you know, just buy things …

Take me to brunch

Screenshot from Damiani.com

OK, yes, I know, I know, I’m sorry: Another watch. But, I mean, this rose-gold, 14.04 carat Damiani “Mimosa-style” watch:

Costs $117,000

Would go so good with a heaping plate of Eggs Benedict, no?

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.