Welcome to Money As If, the bonus autograph on your 34th T-Swift variant. Today’s merch:

Blame COVID?

All hail the queen of

showgirlscapitalism?My boy Steve

— Jeanine

P.S. Liking Money As If? Share that referral link below!

IN THESE, OUR (POSSIBLE) END TIMES

Did COVID spoil our spending habits?

Consider this week’s hot take as just some food for thought, but as I’ve been working to make sense of all the conflicting data about the current economic state of things — which even the Federal Reserve can’t seem to parse — it occurred to me that maybe COVID is to blame.

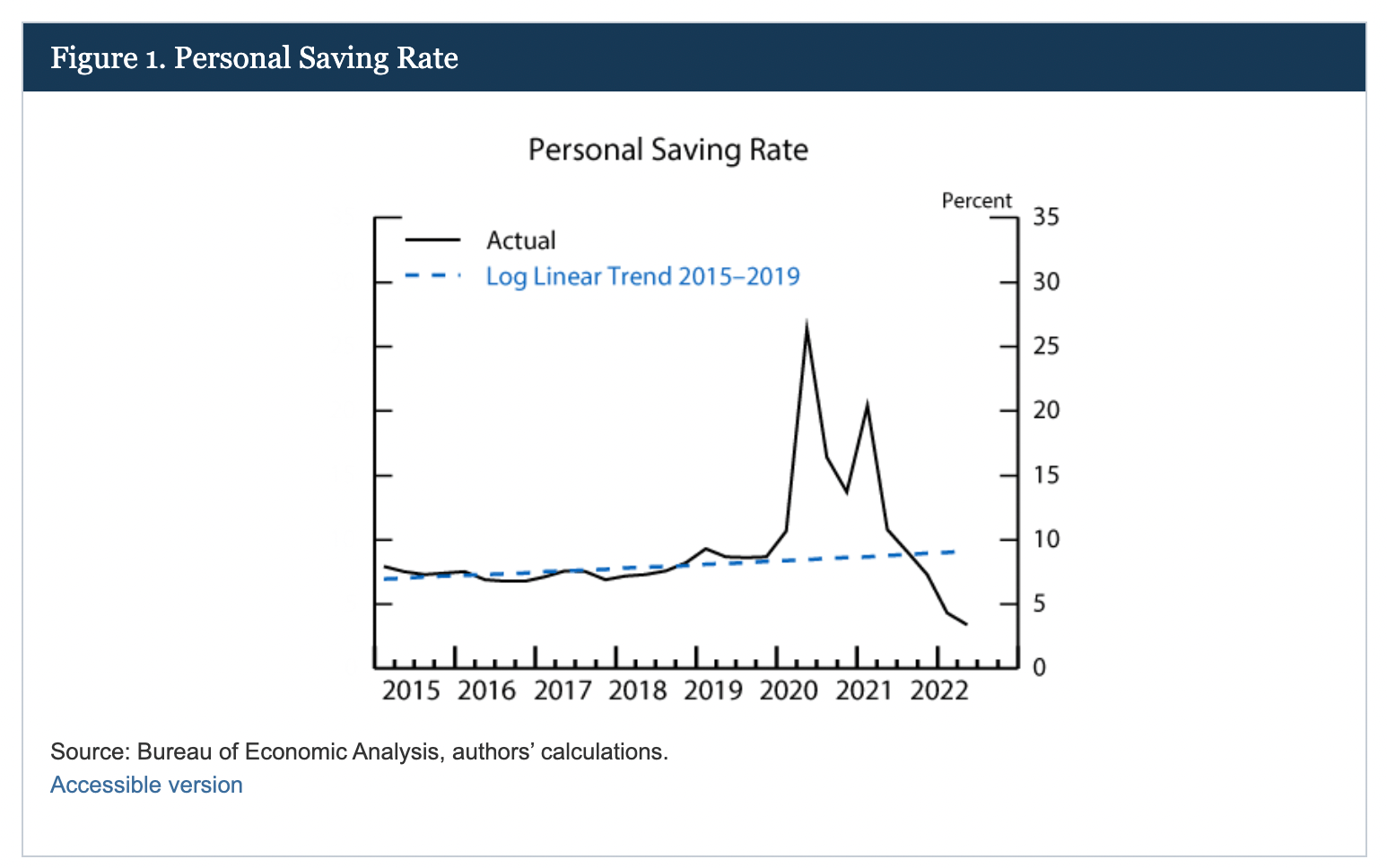

Not for the current state of things, per se, (though that, too), but for the conflicting data itself. COVID, you may recall, effectively forced many households to save via lockdown measures, stimulus checks, and extreme caution. (People afraid of losing their jobs tend to curb how they spend.)

In fact, the Federal Reserve estimates that U.S. households accumulated about $2.3 trillion in savings in 2020 and through the summer of 2021, a figure that, as of 2022, we had started to blow through, largely due to a prolonged period of “revenge spending” that ultimately contributed to our current prolonged and severe bout of inflation.

Covid showing its teeth

Some studies suggest revenge spending has ebbed, but there is evidence Americans’ spending habits have been irrevocably changed by the pandemic. We don’t impulse-buy in stores anymore, for instance. Instead, we do so online. And previously uncommon purchases — like, say, grocery delivery — have become more commonplace. (I don’t know about you, but I rarely, if ever, used DoorDash before the pandemic.)

This fundamental rewiring, coupled perhaps with Gen Z’s well-documented and probably also pandemic-related financial nihilism, could certainly be one of the reasons why consumer spending keeps ticking up even as the job market slows down or, you know, auto loan delinquencies jump to a 15-year high.

It doesn’t help either that COVID-driven inflation and, yes, tariffs are making things Americans could afford in the past decidedly less affordable. It’s hard to accept, for instance, that visiting Dave & Buster’s, of all places (sorry, not sorry) has turned into a luxury.

How to curb your discretionary spending

Of course, I said this was food for thought and largely anecdotal. But in case you’re experiencing a similar kind of disorientation or disconnect around your spending lately and sense you should cut back more and just can’t seem to, here’s a quick refresher on some ways to avoid unnecessary or impulse buys:

Turn off one-click ordering on sites like Amazon or remove saved payment info from other retailer sites.

Implement a 24-hour waiting period before finalizing any non-essential purchases.

Unsubscribe from tempting marketing emails or turn off retailer app notifications.

Roll at least some money over into a savings account that’s not connected to your checking account — and preferably an online one where it takes more time to do money transfers — to limit dips into back-up funds.

Splurge somewhere, just not everywhere. In other words, decide what purchases really bring value and joy to your life — and which ones bring mostly misery, the avoid the latter.

And, if you’re feeling down, remember, it’s not your fault. It’s COVID’s.

You found global talent. Now What?

Deel’s simplified a whole planet’s worth of information on global hiring. It’s time you got your hands on our international compliance handbook where you’ll learn about:

Attracting global talent

Labor laws to consider when hiring

Processing international payroll on time

Staying compliant with employment & tax laws abroad

With 150+ countries right at your fingertips, growing your team with Deel is easier than ever.

‘Tay-capitalist’ edition

I, like perhaps way too many other people out there, have ridiculously complicated feelings about Taylor Swift.

On the one hand, I enjoy her music. On the other hand, she’s a billionaire. On one hand, women, including Taylor Swift and her legion of fans, deserve to have nice things. On the other hand, she’s a billionaire. On one hand, I think she and Travis Kelce are cute. On the other hand … well, you get the idea.

Do you believe in Tay-angels ‘ethical’ billionaires?

I’ve struggled with billionaires as a concept probably since I entered my 30s and realized capitalism wasn’t exactly the pull-your-bootstraps game America likes to pitch its youth.

There are lots of arguments for why one person having that much money — more money than they’ll ever be able to spend, to be clear — is problematic. But the one that’s reinforced my wariness is the idea that there is essentially no way for one person to accumulate that much wealth without exploiting someone or something somewhere.

And while Taylor Swift has proven reliably and even, at times, heartbreakingly generous with her time and money, I simply don’t think she’s cleared that bar.

The way she sells albums and merchandise evokes the same feelings I get when I see a “Buy Now, Pay Later” option at checkout for a $130 decorative vase.

Is anyone — including the most ardent of Swifties — really asking for 34 variants of the same 12-track album? Do these variants need to be released in limited quantities alongside countdown clocks clearly designed to inspire FOMO? (Yes, other artists do this, too. No, most of them do not have the intense and carefully cultivated parasocial relationship with their fans that Taylor Swift does.)

The fact that it’s very difficult to retrace the individual (and, therefore, total) price of buying each and every one of these variants — which disappear from the official Taylor Swift store as soon as they sell out — reinforces my feelings that something here is amiss. (Ethics in business is highly debatable, but “unethical” labels most often relate to transparency or, more pointedly, a lack thereof.) FWIW, NPR’s put their total price tag at around $377, though it admits that’s a low-ball estimate.

And that’s to say nothing of the timing of The Life of a Showgirl release, which comes a year-and-a-half after Swift released 36 variants of a different album, 10 months after the end of a high-priced, nearly two-year-long tour, and during a period of economic pain for all of us non-billionaires, who are all to well acquainted with the increasingly high cost of milk. (Yes, Kim Kardashian is worse, but that doesn’t necessarily mean Taylor Swift is better.)

Anyway, I can go on and on about this, clearly, but instead, let’s …

Peep the merch

🎥 $12

the starting price of a ticket to The Official Release of The Life of a Showgirl Party, an 89-minute movie theatre affair that effectively gave fans early access to the album’s first music video.

🎤 $29.99

for the, wait a second, let me make sure I have this right, The Life of a Showgirl: Sweat and Vanilla Perfume Portofino Orange Glitter variant, which is the one vinyl still available for purchase on Swift’s merch site.

🎀 $40

for a The Life of a Showgirl hair brush (see tweet above), made from cellulose acetate, bamboo, and, genuinely, not enough crazy glue.

👚 $65

for a “You Can Call Me Honey if You Want” pink crewneck sweatshirt, which, TBH, no woman should wear anywhere ever.

🧥 $125

for the now-sold-out The Fate of Ophelia mint faux fur coat, which I guess you can wear when (a) you dress up as Taylor Swift for Halloween or (b) you attend your next Taylor Swift concert.

💃 $8,500

for a version of the custom Kelsey Randall chainmail fringe dress that Swift wore in The Fate of Ophelia video, which, NGL, is quite stunning.

Now, to be clear, I’m not calling out or judging anyone who’s buying these items. (Hopefully, everyone here knows that’s not really my bag.) I am, however, judging the already rich person choosing to sell them. And, listen, we can agree to disagree. In the meantime, I’ll let Cardi B play us out.

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

The labor market is bed-rotting, apparently, which is a fancy, new-fangled 2025 way of saying it’s stagnant.

I was reading about the purported AI market bubble in Morning Brew last week and stumbled upon this fun factoid: Based on the boatloads of money that companies have already put toward AI, annual revenue from the technology would have to be $2 trillion by 2030 to justify the investment. Wall Street isn’t too worried about this, though, which seems … shortsighted, because how are you supposed to make revenue from AI if it puts everyone out of a job?

A good — and short explainer — on the Affordable Care Act subsidies at the center of the latest and, yup, still ongoing government shutdown for anyone who needs a primer, courtesy of NPR.

THIRST TAP

I was today-years-old when I learned …

All about Steve

I’m a teen of the ‘90s, so I’ve long associated Steve Madden with chunky boots, platform sandals, and Big Head Girls. I only recently learned that the brand is a reliable provider of very convincing and affordable knock-offs shoes inspired by iconic luxury footwear.

Case in point: The $59.95 HADYN slide, which caught my eye during a recent trip to Macy’s, given it’s a dead ringer for Hermes’ $840 Oran sandal.

Go ahead and quench that thirst, you guys.

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.