Welcome to Money As If, the world’s best pizza. Today's toppings:

Paying down debts in a rough economy

A fun hack or a hack … for fun

Tarot-to-NO!

— Jeanine

P.S. Money As If will be off next week for Thanksgiving, but we'll be back on 12/5 with a look at how K-shaped recessions can end.

IN THESE, OUR (POSSIBLE) END TIMES

How can we repay all our loans?

There's been lots of not-so-great news about loan delinquencies and defaults lately, in light of, I’m guessing, the Current State of Things™️. See:

A record number of subprime borrowers missed car payments in October.

U.S. foreclosure filings rose by 17% between Q3 2024 and Q3 2025.

Nearly one-quarter of all student loan borrowers were entering or approaching default, as of May.

Credit card debt reached $1.2 trillion, tying an all-time high set last year.

So I thought I’d run down what you can do when job loss, income changes, inflation, or other financial issues make it harder to stay current on key monthly loan payments. Feel free to share this article with anyone you know who might be struggling.

For mortgages

Believe it or not, most banks and mortgage lenders don't want to foreclose on a home. This proclivity isn't altruistic. Foreclosures cost them time and money, and they're better off in the long run if they can find a way for you to keep paying interest.

But it does mean you have options if you start to fall behind. Namely:

Call your lender ASAP to see if they offer forbearance, which allows you to postpone or lower payments temporarily. Alternatively, a lender might offer a loan modification, a special repayment plan, or refinancing to get a mortgage out of delinquency and onto a monthly payment you can afford.

Seek assistance. Some states, counties, and local advocacy or legal aid groups offer mortgage assistance to borrowers in need, though programs have become less common since the COVID-19 pandemic ended. The U.S. Department of Housing and Urban Development (HUD), at least, offers free counseling that helps you find local aid programs and understand your best path forward. You can find a HUD-approved counselor through the agency’s website.

For student loans

If you have federal student loans, you’ve got two big options.

Seek a deferment or forbearance. These options let you temporarily suspend payments. Deferment stops interest from accruing on some balances, while forbearance does not. Keep in mind that both stop progress toward loan forgiveness.

Get on an income-driven repayment (IDR) plan, or, if you’re already on one, re-certify your income and see if that lowers your monthly bill. IDR is changing, following the passage of the "One Big Beautiful Bill," but most new rules don't take effect until July 1, 2026.

If you have private student loans, call your lender ASAP to see if they (like a mortgage servicer) offer forbearance, deferment, or special repayment plans. You might also be able to refinance to a longer repayment term to net a lower monthly payment.

For credit card balances

If your balances are climbing way too high:

Look into a balance-transfer credit card, which lets you move existing high-interest credit card debt onto a new card with a 0% annual percentage rate (APR) on balances for a time, usually 12 to 24 months. The U.S. Bank Shield™ Visa® Card, Wells Fargo Reflect® Card, and Citi® Diamond Preferred® Card currently offer the longest 0% APR periods.

Consider a debt consolidation loan, which is effectively a personal loan you can use to pay off multiple credit cards. Debt consolidation is a good option if you still qualify for a low interest rate, prefer a fixed monthly payment or hard payoff date, and can avoid re-racking up balances on any newly paid off credit cards.

Use the debt avalanche repayment strategy if you're fear re-racking up new balances or can't qualify for a balance-transfer credit card or low-interest consolidation loan. That is, make all your minimum payments to avoid late fees and defaults, while putting as much money as you can toward the balance with the highest APR. (There are other debt repayment strategies out there, but this one usually saves you the most on interest.)

For auto loans

Contact your lender because they, too, sometimes offer hardship programs for struggling borrowers that involve deferrals, extended repayment plans, or, at the very least, moving around your standard due date. NerdWallet has a good round-up of what popular auto lenders, including Chase and Carvana, offer in terms of hardship assistance.

You can also pursue refinancing or downsizing — aka "trading in" — your vehicle for an economy or used car. Sometimes, that move will also lower your monthly insurance payments.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

RECEIPTS

American dive bar

Find yourself a local bar that charges $20 for (excellent) pizza and wings.

After learning earlier this year that visiting Dave & Buster's was, at best, a luxury and, at worst, an exercise in careful planning, Teddy and I have been a bit shy about leaving the house recreational spending.

We did venture, out of curiosity, to a small bar within walking distance from our home, and, reader, what a pleasant surprise! We had delicious wings, pizza, and beer — while watching literally every Sunday football game on at the time — for around $50.

Nice to know the good old American dive bar is alive, well, and more affordable (at least from a value perspective) than, say, the good old American diner.

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

Apologies for the cringe language in advance, but there is simply no better way to express my feelings on this topic: Whenever I encounter a talking head or politician (see tweet above)

pretendingarguing that health savings accounts (HSAs) and high-deductible health care plans (HDHPs) are a "solve" for the U.S.'s broken health care system, I WANT TO YEET MYSELF INTO THE SUN. I’ve written about why before, but for more on how this will do nothing to quell insurance company or Wall Street greed (and, therefore, make coverage or care prices more affordable), please see this recent issue of HEALTH CARE Uncovered.I'd try to parse the new weird jobs reports, but it's from September, so here's The Job Hopper's take instead.

One day, I will

complain abouthighlight my personal challenges of consolidating my approximately 800 old workplace 401(ks), but until then, please enjoy this Wall Street Journal article on how “involuntary rollovers” and other related challenges can cost you so, so much money.

NOT-A-THIRST TAP

And, finally, today, in the "what the hell are we doing here anymore?"

Paying the Fool

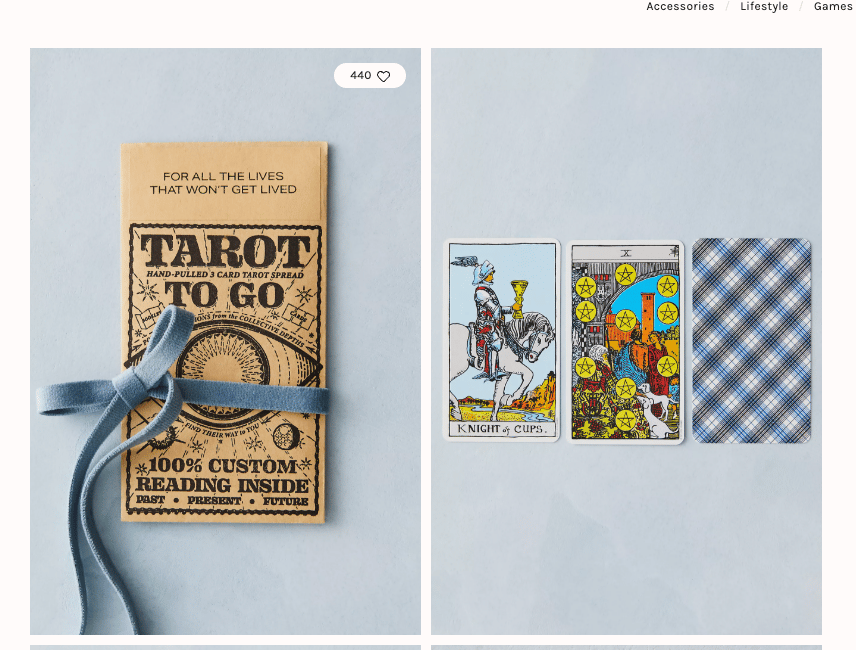

Screenshot from FreePeople.com.

I'm not sure what's more terrifying — and, yes, that's hyperbolic, but also … appropriate — the fact that Free People found a way to charge $20 for three Tarot cards (marketed as a custom "reading" of sorts) or the fact that the product is currently sold out.

To be clear, you can buy a full deck and guidebook for less. You can also find free "readings" on Reddit.

Maybe — 🤞 —the lack of availability reflects a failed experiment and not demand?

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.