Welcome to Money As If, the full-sized candy bar your neighbor's giving out at their annual boo-beque.

Today's treats:

Why we should retire No Spend challenges

American lunch

Summer … ween?

— Jeanine

P.S. Liking Money As If? Share that referral link below!

IN THESE, OUR (POSSIBLE) END TIMES

Can we please cancel No Spend challenges?

No Spend challenges — where you spend money only on the barest essentials for a set time, usually one month, to "simplify your life" and "reset your finances" — have been around for as long as I can remember. But they're experiencing a resurgence over on TikTok and, friends, I'm sorry, but I can't even.

Maybe it's because we just spent a week watching one of the richest men in America ride around Venice with a bevy of celebrities he and his new wife can't truly be friends with, but, yeah, no: I refuse to champion average Americans en masse coloring squares pink to shame themselves for spending $21.74 at Target.

@bujo.budgets Day 24 of No Spend July 🤭 #budget #budgeting #finance #money #savings #nospendchallenge

Say 'hello' to 'conspicuous deprivation'

My big point of contention with No Spend challenges — and this should come as no surprise — is that they, at the very least, normalize and, at worst, glorify going without.

You'll find all sorts of variants out there. People use different timelines and have different end games, some of them quite noble. (Save for vacation! Pay off credit card debt! Never buy a handbag again!) However, the basic rule remains the same. No non-essential spending. So that means cutting out:

Clothes, shoes, or accessories

Eating out or ordering in

Haircuts, manicures, or beauty products

Coffee, booze, or avocado toast

Entertainment

Labubus

[Insert other fun thing here]

In other words, all you're “permitted" to buy is housing, gas, and groceries. Rich people do conspicuous consumption. We do conspicuous deprivation. Cue Selina Kyle in The Dark Knight Rises, because, yup, I now have that scene on loop in my head.

We live in a society

There are plenty of articles covering why this level of restriction isn’t likely to lead to better financial habits in the long-term. You’re effectively doing a crash diet with your money and could easily wind up spending all your savings (and then some) once the no-spend month ends.

But, listen, I get that many people might need to do this right now. We're at an inflection point of sorts, where going to the diner (see next section) has effectively become a luxury, and "Buy Now, Pay Later" at checkout has people considering adding $130 vases to their shopping carts.

I also understand that these days, everyone films everything, including things that aren't all that fun or great for them. Like eating a death chip, dumping ice-cold buckets of water on our heads, or doing yoga poses while wearing sky-high stilettos.

But I do wish that maybe while people were doing these no spend challenges, they were at least a little … mad about it. (If Nicholas Cage can spend $300,000 on a dinosaur skull, you should be able to buy a handbag once every four years.)

I also wish we wouldn’t, you know, treat them like a 90s-era chain letter you need to immediately forward to 25 friends (who must immediately forward it to 25 friends who must immediately forward it to 25 friends), lest Bloody Mary come and poke our eyes out.

@thesavvysagittarius Are you joining me?! #NoSpendApril #nospendmonth #nospendchallenge #loudbudget

My 'Damn the man' tips for saving money

I’ve mentioned this a few times in past issues, but we did a big budget audit earlier this year when our household income changed dramatically, and I learned a few things that might prove helpful if you need to cutback and want to do so in a non-toxic way.

I call them my 'damn-the-man' tips for saving, because they're focused less on going without and more on working the system.

Un-creep your bills. You might be surprised at how high some household expenses climb just because you've stuck so long with the same service provider. Car insurance is significant area of opportunity, because it is relatively easy to switch to cheaper, but similar coverage if your current insurer doesn't want to negotiate. (See here.) Other opportunity areas include utilities, cable, or mobile service plans.

Find and cancel zombie subscriptions. That's what I call recurring charges for stuff you either (a) don't even remember signing up for or (b) no longer use but are still paying for, thanks to auto-pay and a linked debit or credit card account. When I reviewed our most recent bank statements, I found a few unexpected or obsolete charges, including an old Duotrope membership and a $21.31 subscription to Adobe Acrobat that I believe I used once to convert a contract into a PDF, maybe?

Re-evaluate value. Sometimes, you're simply not getting what you're paying for anymore, and an item that was worthwhile at one point in time has outlived (or now out-costs) its use. You may recall that we canceled our pet insurance after self-insuring became a better and more affordable option. But I'll also point out that this strategy doesn't just apply to cutbacks. You can sometimes get more, for instance, by moving your money to a high-yield savings account if the annual percentage yield (APY) on your current one is no longer competitive. Ditto if a credit card's annual fee has increased, but its rewards have decreased in relation to your spending. In other words, feel free to cut ties or upgrade when services or goods no longer serve you.

Start with getting rid of one big thing. This step isn't entirely mutually exclusive, as it can relate to value, zombie subscriptions, and bill creep; however, there's probably something in your budget that you can eliminate without truly depriving yourself. For me, this was my Orange Theory membership, which, listen, no real shade to Orange Theory; I think it's great, but it's also expensive, and I can technically go for runs around the block.

I shaved around $1,200 off our monthly budget (for a total of $14,400 per year) by doing these things, so I promise they have utility. No no spending required.

RECEIPTS

American Lunch

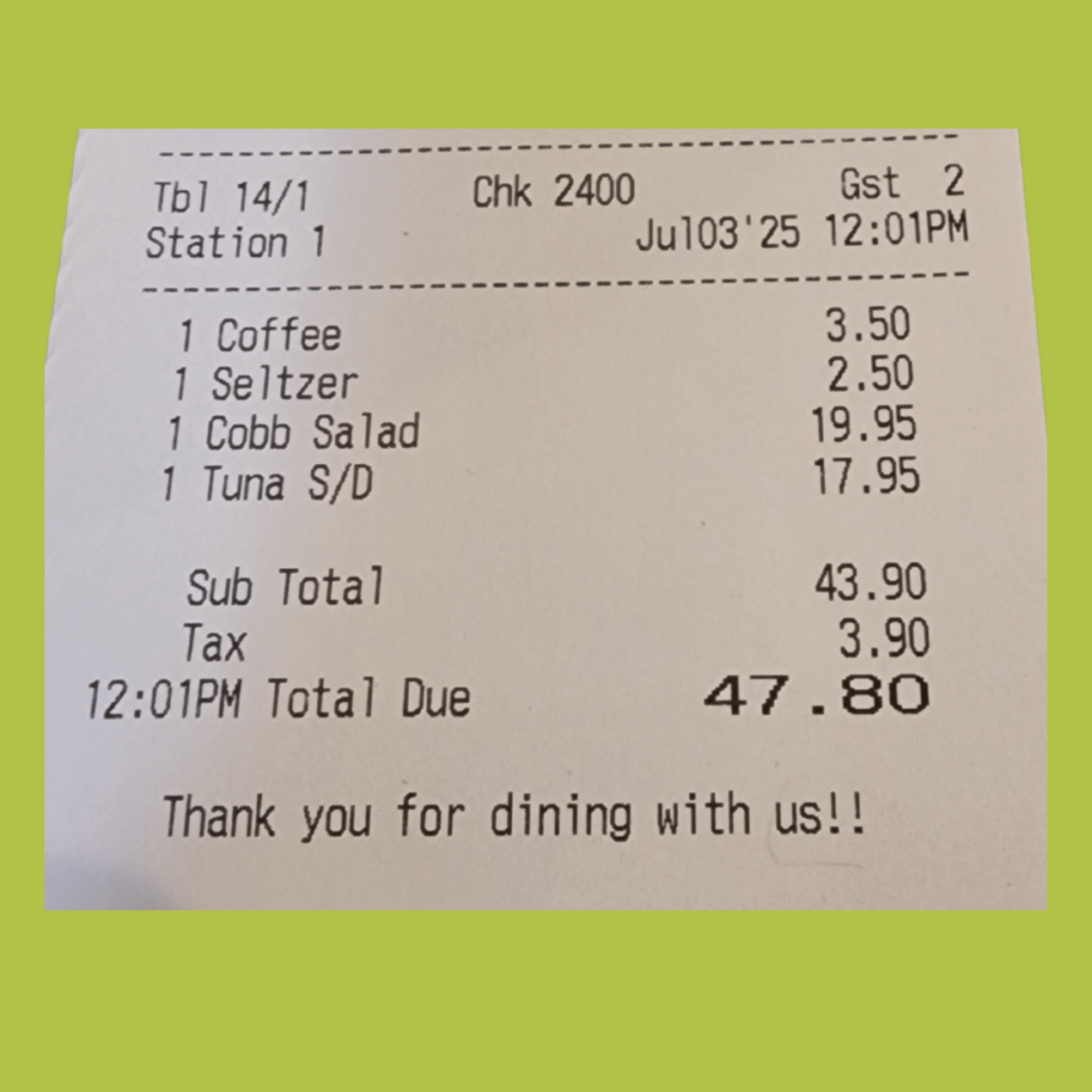

My mom treated me to a day at the head spa last week (more on this in a coming issue) and we got lunch at the diner next door afterward. It turns out that a tuna melt, Cobb salad, seltzer, and a cup of coffee will set you back close to $60 these days, at least if you're in Staten Island, New York.

We tipped $10.

I guess we should have opted for one of the $20.95 lunch specials. At least then we would have gotten soup and a slice of cheesecake.

Summerween edition

Why are inflatable Boo pools appearing in your social media feeds? Because Halloween now happens twice a year!

🍍 $10

for a glowing pineapple jack-o'-lantern from Walmart, part of the bulk retailer's "Summer Frights" collection.

🥶 $17.95

for an 8-ounce bottle of "I Scream Float" mist, part of Bath & Body Works Summer-ween 2025 fragrance collection.

🎃 $39.95

for a pumpkin pitcher from Pottery Barn, handcrafted from soda-lime glass, perfect for your Halloween lemonade needs.

⚰️ $51.99

for an inflatable coffin cooler, Dracula included, from The Beistle Company, courtesy of Wayfair.

🧙 $298

for a giant witch iron garden stake from Anthropologie's Halloween collection; sidekick black cat available for $58.

👻 $850

for a light-up Ghost pool floatie from a company I won't name, so this email doesn't end up in the wrong folder. An option if you really want to take Summerween to the next level.

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

Oh, boy, someone — maybe Gen Z, maybe Fast Company, maybe some guy named Joshua Charles, I dunno, someone — is trying to rebrand PTO as "mini-retirements."

OK, I swear I won't mention Labubus again for at least the next 13 issues, but, given this take contradicts everything I've ever said about them, I feel obligated to share: Psychologists argue these ugly-cute toys are, in fact, good for your mental health.

A look at how weight-loss drugs, like Wegovy and Ozempic, are changing how we spend while we travel. Side note: What exactly is a 'festive" restaurant, and how might it differ from a non-festive one?

THIRST TRAP

I wanna meet in 2003

And, finally, today, in things I would buy if I could, you know, just buy things …

Screenshot from Miumiu.com

Paris Hilton is calling. She wants her $3,750 Miu Miu denim skirt from the early aughts back, thank you.

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.