Welcome to Money As If, the confetti inside your knock-off Fendi. Today’s shiny disco balls:

Shape theory

Beware this big old bank imposter scam

How to hide your bling

— Jeanine

P.S. Liking Money As If? Share that referral link below!

IN THESE, OUR (POSSIBLE) END TIMES

Is the economy E-shaped?

So I spent (some) time looking into this question after Bank of America released consumer spending data last week, suggesting that nope, there aren't two distinct groups in this economy; there are three! And, candidly, I'm still a bit stuck at "OK, sure, what else is new?"

I also couldn't tell whether changing our economy's designation from a "K" to an "E" even mattered all that much, given, at first glance, it seemed that we were talking about this vs. this:

The U.S. economy: Nordic ruins edition

IMHO, the difference (an extra line trending downward), while important in some debates, for sure, doesn't fundamentally change the core dynamics of what I consider our Current State of Things™️. Whether K- or E-shaped:

We're still talking about haves and have-nots.

We still have an economy that works for the uberwealthy while leaving the majority of the country behind.

We're still waiting for a major shock to hit the top of the letter so a recovery (for all) can begin.

So why write about this? Because during my research, I realized that some talking heads — not all of them, but some of them — are pitching the two shapes as more like so:

The U.S. economy: Wishful Thinking Edition

In this scenario, two economic groups are doing at least OK. One, of course, is doing much, much better than the other, but both are still willing to spend. Never mind that the middle rung of the E might have to take on debt or borrow from their 401(k) to do so. The economy, in aggregate, remains fundamentally sound and well-positioned for growth. No need for anyone, especially the markets, to panic.

In other words, this debate isn't so much about economic analysis. (FWIW, "E" is not an official shape for recessions.) It's about the continued and perhaps somewhat unconscious coupling of realities in which Wall Street looks at, say, AI and sees a reason to rally, while Main Street looks at AI and worries that robots are about to take everyone's jobs.

It's also one of the reasons why traditional economic indicators, and, increasingly, market reactions to them, feel contradictory, incomplete, or outdated. One segment (or two) has no choice but to experience; the other segment can afford to see what it wants to.

Wake up to better business news

Some business news reads like a lullaby.

Morning Brew is the opposite.

A free daily newsletter that breaks down what’s happening in business and culture — clearly, quickly, and with enough personality to keep things interesting.

Each morning brings a sharp, easy-to-read rundown of what matters, why it matters, and what it means to you. Plus, there’s daily brain games everyone’s playing.

Business news, minus the snooze. Read by over 4 million people every morning.

RECEIPTS

Alert: Bank impostors are impostoring

In 2022, after Teddy charged a guitar to a Chase credit card, the bank repeatedly reached out to verify the purchase.

When I ignored those calls, Chase blocked the transaction, assuming it was fraud — something we learned weeks later when Guitar Center told us that's why the instrument was never delivered. (FWIW, the charge was listed as "pending" the entire time.)

I share this to explain why I answered a call from "Chase Bank" a few weeks ago, even though my instinct is to ignore unsolicited calls, especially from financial institutions.

Of course, things felt off from the start. The person on the other end of the line alleged that someone abroad was attempting to empty my bank account, though I couldn't see any suspicious activity on my end.

They also weirdly went out of their way to emphasize that addressing the issue wouldn't require them, purportedly Chase, to obtain any of my personal information. (Admittedly, I had been waiting for the caller to ask for my Social Security number, so I could confidently conclude they were scamming and hang up the phone.)

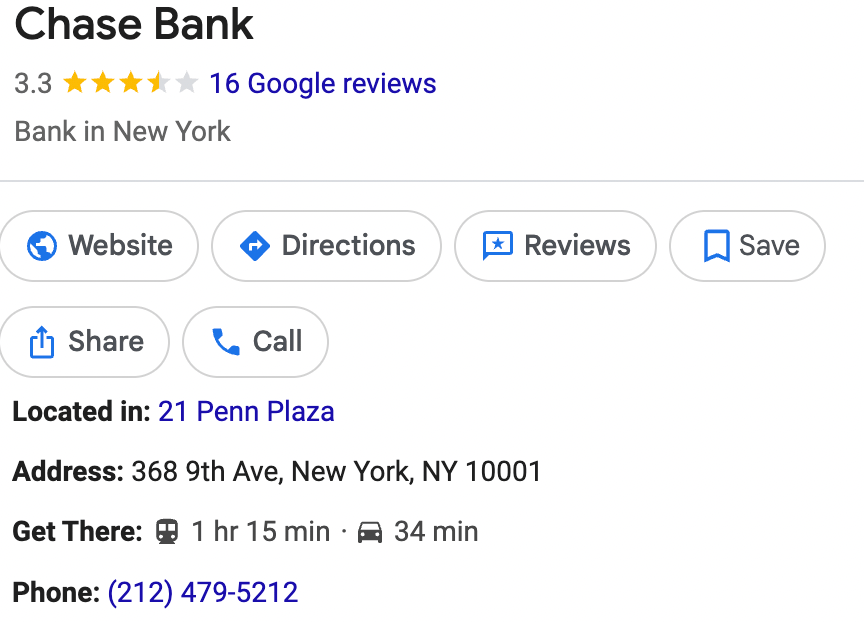

I was momentarily thrown off because, while listening to the caller's spiel, I had Googled their number and found it listed as a seemingly legitimate contact for Chase.

I've covered identity theft as a personal finance reporter. I’ve also seen Season 13 of The Real Housewives of New Jersey. I figured the caller might be spoofing me. So I did what any security expert would tell you to do: I disconnected and called the bank directly, using the customer service number listed in Chase's mobile app.

Lo and behold, the bank confirmed it wasn't trying to contact me and that it didn't see any signs of fraud on its end regarding my accounts. And that's how I successfully evaded a (slightly more) sophisticated bank scam.

I wanted to share this experience because, while covering personal loans for MoneyLion, I noticed an alert on some small banks' websites that described a similar scheme.

First Liberty Bank serves Oklahoma City.

Shortly thereafter, Chase sent me a warning email about scammers impersonating banks, which I, quite frankly, thought was from the scammers who called me, because it seemed designed mostly to get me to click "review scams." The bank, however, confirmed it was part of a legitimate effort to educate customers, though it didn't mention any specific ongoing threats to be aware of.

How to avoid a bank imposter scam

Still, these scammers are clearly working hard, so, just in case, here are some tips for avoiding bank imposter scams:

Know the big signs, which include scare tactics ("your money is being stolen RIGHT NOW!") and requests for private account information, like a PIN or a mysterious one-time access code. Banks usually have a policy against asking for these things when they contact you by phone. They also won't ask you for money or to transfer money. (Neither, incidentally, will a CIA agent.)

Be wary of pretty much any unsolicited contact, not just by phone, but by text or email, too. The latter could be phishing attempts, so don’t click on any links. Instead, disengage and contact the bank directly to see if they're trying to reach you. Use the phone number on the back of your credit or debit card or within your mobile app.

Leverage advanced security measures, like two-factor authentication, long and strong passwords, and withdrawal or transaction alerts, which can make accounts harder to hack into and help you spot fraudulent activity in real-time.

Contact the bank directly if you think you might have fallen for a scam. That way, they can freeze accounts or issue new payment cards, if necessary. You can also consider setting up a credit freeze if you gave out or believe a scammer obtained valuable personal information, such as your Social Security number. That stops scammers from opening new credit accounts in your name.

Report the scam to the Federal Trade Commission (FTC), FBI Internet Crime Complaint Center, and your State Attorney General. They use complaint patterns to issue public alerts, allocate broader investigative resources, and identify scam networks.

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

How are Americans of all income levels saving on groceries in 2026? By shopping at Walmart, natch.

I've refrained from talking about wage data in recent recession-based discussions, because it's quite frankly all over the place, but this piece from economist Mike Konczal does a good job outlining why incomes increasing alongside inflation isn't curbing affordability issues. TL;DR: The prices of basic living essentials, including housing — i.e., the stuff we can't avoid buying — are the most out of control.

Service-y: How to avoid applying for — and wasting time on — ghost jobs; that is, openings that companies have no real intention of filling, at least any time soon.

THIRST TRAP

And, finally, today, in things I would buy if, you know, I could just buy things …

Fendi’s stealth wealth assist

Screenshot via Fendi.com.

A bunch of readers clicked on last week's Thirst Trap, so I figured I'd bring the section back for a bit. Plus, I am genuinely enamored with Fendi's Peekaboo bags.

This one — classic black leather with an equally classic confetti bling — costs $10,000, but prices vary, depending on size and how much boo the purse actually packs.

A good way to stealth your wealth, if you have any (and are so inclined).

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.