Welcome to Money As If, the luxury knockoff bag so fine you need an X-ray machine to tell the difference.

Today's merchandise:

The good, the bad, and the ugly of 401(k) loans

Beach swag bingo

I

carriedwrote my debt on a watermelon

— Jeanine

P.S. Liking Money As If? Share that referral link below!

IN THESE, OUR (POSSIBLE) END TIMES

Is it bad to borrow from your 401(k)?

A question I see popping up on Reddit — and clearly a thing, given a Vanguard survey from earlier this year found that a record number of 401(k) participants (4.8%) took hardship withdrawals in 2024.

Borrowing from a retirement account gets a bad rap because you’re foregoing tax breaks and compounding interest, missing out on potential market gains, and, more broadly, [insert finger-wagging here] jeopardizing your long-term financial security.

But putting aside the stigma of doing a bad job at saving for retirement (which, I mean, aren’t we all?), borrowing from a 401(k) is sometimes not the worst solution to a pressing money problem.

Robbing Peter to pay Peter

Yes, there are drawbacks and risks, which I’ll get to in a bit, but there are also benefits that can make this route a relatively good source of much-needed cash. For instance:

401(k) loans are pretty easy to get. So long as your plan permits them (not all do), you generally won’t face a lengthy application process or credit check.

They’re not reported to the credit bureaus, so that credit check, the outstanding balance, and any missed payments won’t affect your credit score or your debt-to-income (DTI) ratio.

They have low interest rates, and, in fact, you can argue you’re not paying interest at all, given that money goes back into your 401(k) account and not a lender’s pocket.

They offer flexible repayment terms. Most 401(k) loans must be repaid within five years via quarterly payments, although you could enjoy a longer term if you use the funds to buy a house, and, if able, you can pay the loan early without penalty.

None of this is me suggesting you should just go ahead and borrow from your 401(k) account tomorrow. It’s just to say that you don’t need to beat yourself up too much if life happens and you have to. Of course, let’s put some parameters around “life happening.”

“There are some cases where a 401(k) loan can make sense, especially if the borrower's credit score is low and they are facing a high-interest debt or urgent expenses,” says Michael Boggiano, Managing Partner at Wealthcare Financial. “I’ve recommended this strategy to clients who have no other affordable financing options, but only when there’s a clear repayment plan in place.”

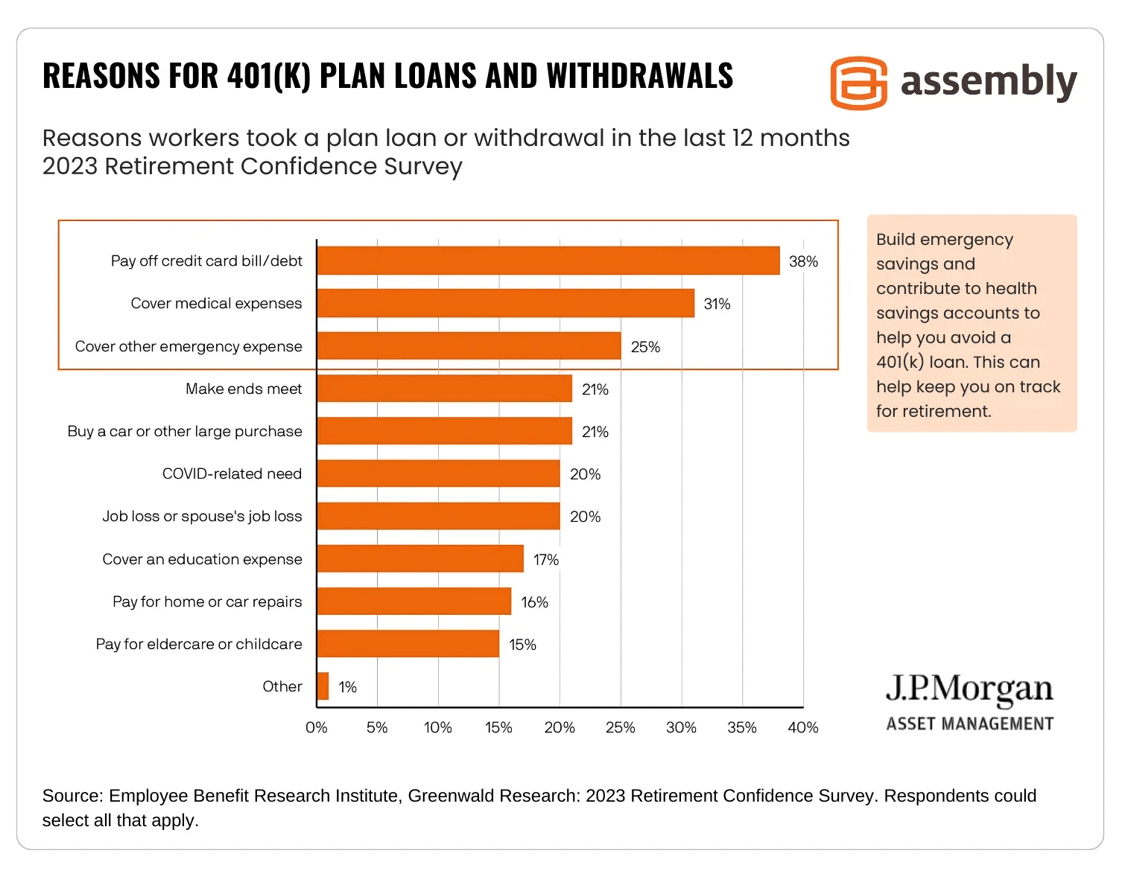

The most common reasons Americans turn to a 401(k) for funding.

And here’s the rubs

That clear repayment plan is important because, if you fail to restore the balance within the allotted time, a 401(k) loan turns into a 401(k) withdrawal and triggers all types of penalties most people want to avoid. Namely, you’ll owe taxes and pay an extra 10% on any outstanding balance if you’re not yet over 59.5 years of age.

The other big risk is that losing or leaving your job calls the loan due and truncates that five-year repayment period. In this scenario, most plans require you to repay any outstanding balance within 60 to 90 days of your termination date.

If you can’t, they’ll take what you owe out of the retirement account, known as a loan offset, and, yup, you’ll have to pay taxes and penalties on those funds.

A few other drawbacks (aside from, you know, all that retirement growth stuff) to consider or at least be aware of:

You can only borrow from an active account. You can’t borrow from an old 401(k) from your former employer; those accounts are only eligible for taxable withdrawals.

You can face funding limits. Most 401(k) loans are limited to $50,000 or 50% of your vested account balance, whichever is less.

401(k) loans are tax-inefficient. “Repayments are made with after-tax dollars before being taxed once more when withdrawn during retirement, a form of double taxation that takes place over time,” says Dennis Shirshikov, a finance professor at the City University of New York.

How to do a 401(k) loan

If you’re considering a 401(k) loan, here are some tips for coming out ahead.

Have a strong repayment plan, which we covered already, but bears repeating, given the steep tax penalties associated with not repaying the loan. “Set up autopay if your plan allows it and treat this like any other debt,” says Michael Foguth, founder and retirement specialist at Foguth Financial Group.

Read your plan’s policies. This way, you know if loans are allowed and, perhaps more importantly, what happens if you leave the employer sponsoring the account. Some plans allow for loan offset rollovers to help you avoid tax consequences, although that’s typically the exception, not the rule, and the process is often complicated.

Consider your job stability (and satisfaction), given you’re likely to trigger early repayment terms if you voluntarily or involuntarily make a move. Put a plan in place to cover the outstanding balance in a worst-case scenario.

Keep up with 401(k) contributions, if possible. Aim to at least meet your employer’s match. “Don’t lose that free money,” Foguth says.

Consult with a financial advisor. 401(k) loans can be, but certainly aren’t always your best option in a tricky money situation. Depending on your financial and credit profile, personal loans, home equity loans, or 0% intro annual percentage rate (APR) cards can be a better source of emergency funding. The decision largely boils down to what interest rates you can qualify for — or what interest you’re already paying on outstanding debts — vs. estimated investment returns. A financial expert can help you do the math and assess if there are alternatives in your current portfolio.

“The key is matching the loan to your need—and not borrowing out of habit,” Foguth says.

Beach swag edition

Perfect for your next day at the beach. Or not.

🏐 $12.99

for a Crocodile Creek’s durable beach ball at Walmart; the toy is one of The Bump’s picks for best beach toys for kids.

🦩 $24.50

for an oversized, reversible, and flamingo-emblazoned beach towel by island-life-inspired brand Tommy Bahama.

🪣 $64.99

for a 14-piece luxury silicone beach toy set from sustainable toy maker Moonkie; the luxe set includes a swankier gift bag than the standard $54.99 option.

🏖 $94.99

for the Sun Ninja pop-up beach tent over at Walmart; the tent tops Wirecutter’s list of the best beach umbrellas.

🩱 $230

for a Burberry bathing suit for your 3-to-14-year-old; in the designer’s signature check pattern, natch.

👜 $350

for the Marc Jacobs beach tote bag, which comes with a tag reminding you that the bag “is as precious as your skin” so “please protect it from water and sun damage.”

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

@_jenn.allan Day 12 of 30 asking ChatGPT for one task daily to make money to pay off $23,000 in credit card debt #chatgpt #creditcards #debtpayoff #deb... See more

This story about how ChatGPT helped one Tik-Toker pay off over $11,000 of her credit card debt is a little misleading in that most of those funds came from a brokerage account the woman just kind of forgot about, but the part where it tells her to write what she owes on a watermelon and auction it off on eBay as “debt art” — a thing, apparently — is pretty priceless.

Forget the millennial pause. Workplaces now have to deal with the Gen Z stare.

OK, so the resurgence of No Spend challenges is seemingly related to “revenge savings,” a trend that entails becoming aggressively frugal to get back at … ourselves for being bad at money.

THIRST TRAP

He(art) attack

And, finally, today, in things I would buy if I could, you know, just buy things …

@coveteur A closer look at Schiaparelli’s viral beating heart necklace, which is inspired by Carlos Alemany and Salvador Dali’s functional Royal Hea... See more

Don’t ask me why this dress is backwards and has a fake breastplate. (I’m not going to pretend to understand Haute Couture fashion.) But the viral Salvador Dali-inspired beating heart necklace in Schiaparelli’s 2025-2026 Fall Collection is certainly something else.

I can’t tell you how much it costs, though. Schiaparelli, sadly, did not respond to my overtures.

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.