Welcome to Money As If, the $100,000 necklace you don’t want to buy. Today’s statement pieces:

Bunking the myth of AI data centers and your utility bills

Survey says!

Whatever

— Jeanine

P.S. Liking Money As If? Share that referral link below!

IN THESE, OUR (POSSIBLE) END TIMES

Why are our energy bills so darn high?

I heard through the grapevine that AI data centers were jacking up our energy bills, which essentially means Teddy complained to me about this exciting new trend a few days after I saw an article on social media about it.

Fortunately for anyone who wants to get angry about paying for ChatGPT to regurgitate Reddit answers for college essays (and, perhaps, unfortunately, for everyone else), I can report that this is not a conspiracy theory.

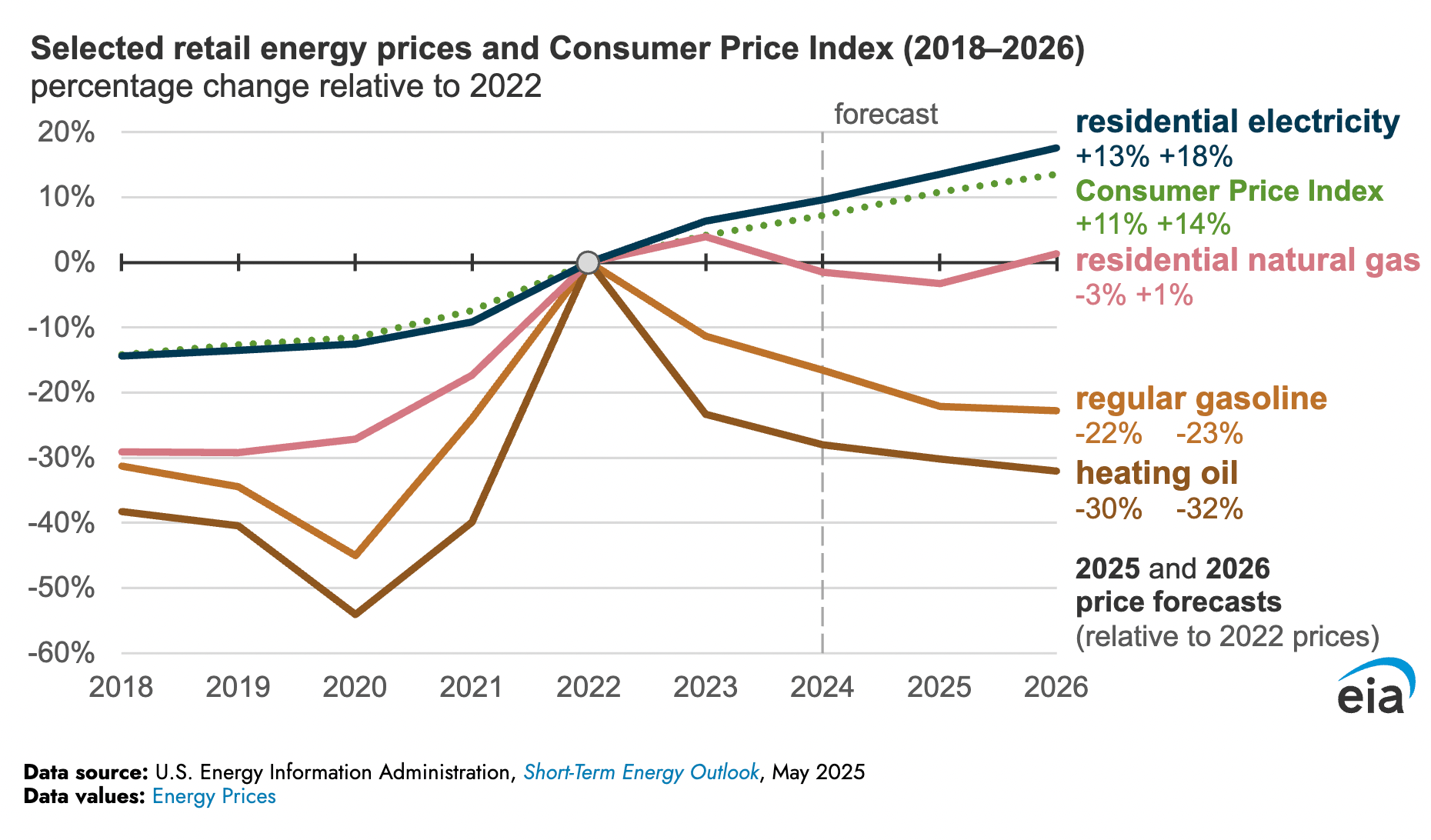

AI data centers, which run 24/7 and require tons of energy to cool, are increasing utility bills across the country — they’re just not the only factor at play.

Energy surge

Other reasons for U.S. electrical prices rising faster than the rate of inflation include: higher utilization, tariffs (which, among other things, make importing the oil and gas that fuels electricity plants pricier), busted power grids (looking at you, Texas), extreme weather events busting power grids (hey there, Florida), and general infrastructure upgrades.

Energy prices are going up anywhere from 8% to 26%, depending on where you live.

What’s affecting your bills specifically or most significantly depends on where you live.

“In some states, utilities pass on the costs of repairing or replacing damaged equipment after extreme weather, while in others, natural gas price swings hit particularly hard,” explains Nick Barber, co-founder at Utilities Now. “In the Northeast and Midwest, old homes that are poorly insulated lead to high energy use, whereas in the South and West, increased air conditioning during extended heat waves has caused bills to soar. Variability between states is considerable; your bill often depends as much on the local utility's rate plan and fuel mix as on your usage.”

AI data centers, FWIW, are particularly problematic for people living in Iowa, Ohio, Oregon, and northern Virginia, where these facilities (which are admittedly everywhere in the U.S.) tend to cluster. But they could easily affect or exacerbate issues in a town near you.

“The concern is that in areas where the grid is already strained, in states like Texas or Virginia, the additional load from AI and crypto mining centers could cause utilities to raise rates to fund grid upgrades or manage demand,” Barber says. “In a few years, their impact may rival or surpass that of industrial sectors that took decades to develop.”

ChatGPT, when asked about what it’s doing to our power grids. No accountability with this one!

Some good news, I suppose: While energy rates might continue to rise in the short term, there is some hope they’ll subside in the long run.

“We believe that the sizeable investments utilities are making now to modernize the grid are going to pay off in the form of efficiencies over time, so no, we don’t expect energy bills to continue to rise at the current rates we’ve seen in 2025,” says Adam Cain at ElectricityRates.com.

How to lower your energy bills

In the meantime, there are lots of little things you can do to lower your monthly electric bill. Candidly, though, I’m sure you’ve heard most of them before. For instance:

Install smart thermostats.

Upgrade to LED lights.

Buy Energy STAR appliances.

Seal leaks and your entire attic.

Hang room-darkening curtains.

Regularly defrost your freezer and change your AC filters.

Unplug TVs, gaming consoles, computers, and routers overnight.

Run washers, dryers, or other high-load devices during off-peak hours (so, not 4 p.m. to 9 p.m., when everyone else is doing their laundry).

Switch to solar. (Yes, I know, easier said than done.)

My biggest recommendation is to at least make sure you’re on a budget billing or equal payment plan, which estimates your annual usage and divides that into 12 equivalent monthly payments for the year. We were not on an equal payment plan and got absolutely whacked with a $647 PSE&G bill in July. (We live in an upstairs apartment, Teddy gets hot, one of the ACs wasn’t installed correctly, idk. 😭 )

Anyway, after changing over to the equal payment plan, our monthly billing stabilized to $241.88, which is … not great, but also not close to $700. (For reference, our winter energy bills were between $113 and $168 per month and we live in New Jersey.)

Equal payment plans aren’t helping you save, per se, but they will protect you from an unexpectedly high utility bill that eats all of your monthly discretionary income or, worse, emergency fund.

Beyond that, there are federal, state, and even provider savings programs you can look into if you’re truly cash-strapped, including the Low Income Home Energy Assistance Program (LIHEAP) or Universal Service Fund (USF).

Business news doesn’t have to be boring

Morning Brew makes business news way more enjoyable—and way easier to understand. The free newsletter breaks down the latest in business, tech, and finance with smart insights, bold takes, and a tone that actually makes you want to keep reading.

No jargon, no drawn-out analysis, no snooze-fests. Just the stuff you need to know, delivered with a little personality.

Over 4 million people start their day with Morning Brew, and once you try it, you’ll see why.

Plus, it takes just 15 seconds to subscribe—so why not give it a shot?

RECEIPTS

I’m on it!

A big thank you to everyone who answered our reader survey last week. It was quite eye-opening — and validating, even. I’m so glad that Spending (smartly or stupidly) topped the list of personal finance topics you’re all most interested in reading about. In fact, that question panned out like this:

Spending (smartly or stupidly): 28.57%

Budgeting: 14.29%

Wealth-building: 14.29%

Insurance: 14.29%

Finance mindset and behavior: 14.29%

Career and income: 7.14%

Retirement and long-term planning: 7.14%

Credit and debt management: 0%

Taxes: 0%

So, OK! Some stupid spending stories coming right up — and, yes, for sure, we’ll just ignore tax season.

FRESH GREEN

Nowadays, most financial takes are boilerplate. These aren't.

Oh, look, mortgage rates finally dropped (a little).

What to make, what to make of this story from the WSJ that points out — and, in a strange attempt to be objective, I suppose, makes an argument for — corporations cutting staff, but not private jet rides for their CEOs. 😡

On the flip side, thank you, NPR, for pointing out that being in credit card debt doesn’t automatically make you bad at money. Sometimes, life happens, and we’ve all experienced how difficult it is to create a suitable emergency fund, now that we’re expected to sock away, oh, two years’ worth of expenses.

THIRST TRAP

And, finally, today, in things I would buy if I could, you know, just buy things …

Fine, jewelry

Screenshot from BULGARI.COM.

Maybe it’s just me; maybe it’s just the economy. Maybe when luxury goods you can’t actually afford start appearing so often in your Facebook feed, they all start to look the same. I’m not sure. I am, however, a hard time getting legitimately thirsty for stuff.

Still, this Celestial Mosaic Necklace from Italian luxury brand Bvlgari is fine, I guess.

Got questions, comments, receipts, tips, thirst traps, etc. you’d like to share? Send them to [email protected].

This article is for educational purposes only. We don’t recommend or advise individuals to buy, not buy, sell, or not sell particular investments or other assets, as everyone’s circumstances are different. Also, it’s your money and ultimately up to you to decide the best use for it.